Olive oil: Mediterranean goldAgricultural

Alicia Langreo

PhD Agricultural Engineering

Isabel Benito

Technical Agricultural Engineer

Saborá, SL Market Research and Reports

Madrid - Spain

Olive growing has its origins in the Middle East over five thousand years ago. From there it spread across the entire Mediterranean and becoming essential in the region’s landscape and culture. Its dwellers have used olives as a source of nourishment, but also to make beauty products, fuel for lamps and lubricants, among other applications. Though olive trees are typically a rain-fed crop, irrigated cultivation is on the increase both in traditional and in new growing regions. Spain is the world’s largest olive growing country, taking into account global olive grove surface area, oil production and regarding consumption, it is the second country after Italy.

International context

According to FAOSTAT1, olive plantations covered some 9.6 million hectares in 2011, 98.4% of them in the Mediterranean region (see Figure 1). Over the last five seasons, the global average annual production of olive oil stood at almost 3 million tonnes according to the IOC2, a 6% increase on the previous five-year period. A 75% share of this aggregate volume is consumed in Mediterranean countries. Italy and Spain top of the list with respectively 24% and 19% of global consumption. Outside of this region, the US is a significant consumer with 9% of the total. Consumption is performing well, registering a 7% increase over the past five years, a figure that in traditionally non-consuming countries rises above 35%.

| Region | Surface area | Oil production 2006/2007 to 2011/2012 | Consumption 2006/2007 to 2011/2012 | |||

|---|---|---|---|---|---|---|

| 2011 ha | %/Total | 1,000 t | %/Total | 1,000 t | %/Total | |

| Non-EU Mediterranean countries | 4,784,097 | 49.7% | 703 | 24.0% | 495.0 | 16.9% |

| Tunisia | 1,779,950 | 18.5% | 157 | 5.3% | 36.0 | 1.2% |

| Turkey | 798,493 | 8.3% | 144 | 4.9% | 110.7 | 3.8% |

| Syria | 684,490 | 7.1% | 152 | 5.2% | 114.4 | 3.9% |

| Morocco | 597,513 | 6.2% | 106 | 3.6% | 80.0 | 2.7% |

| Other | 923,651 | 9.6% | 145 | 4.9% | 153.9 | 5.3% |

| EU Mediterranean countries | 4,697,084 | 48.8% | 2,161 | 73.6% | 1,687.0 | 57.6% |

| Spain | 2,330,400 | 24.2% | 1,297 | 44.2% | 549.1 | 18.8% |

| Italy | 1,144,420 | 11.9% | 477 | 16.2% | 700.9 | 24.0% |

| Greece | 850,000 | 8.8% | 320 | 10.9% | 238.5 | 8.2% |

| Other EU countries | 372,264 | 3.9% | 67 | 2.3% | 198.5 | 6.8% |

| Total Mediterranean region | 9,481,181 | 98.4% | 2,864 | 97.6% | 2,182.0 | 74.6% |

| Non-Mediterranean | 153,395 | 1.6% | 70 | 2.4% | 744.3 | 25.4% |

| Argentina | 62,498 | 0.6% | 22 | 0.8% | 5.3 | 0.2% |

| Australia | 30,407 | 0.3% | 15 | 0.5% | 42.0 | 1.4% |

| USA | 16,794 | 0.2% | 3 | 0.1% | 262.8 | 9.0% |

| Chile | 15,091 | 0.2% | 12 | 0.4% | 7,8 | 0.3% |

| Other | 28,605 | 0.3% | 18 | 0.6% | 426 | 14.6% |

| Total world | 9,634,576 | 100.0% | 2,934 | 100.0% | 2,926.3 | 100.0% |

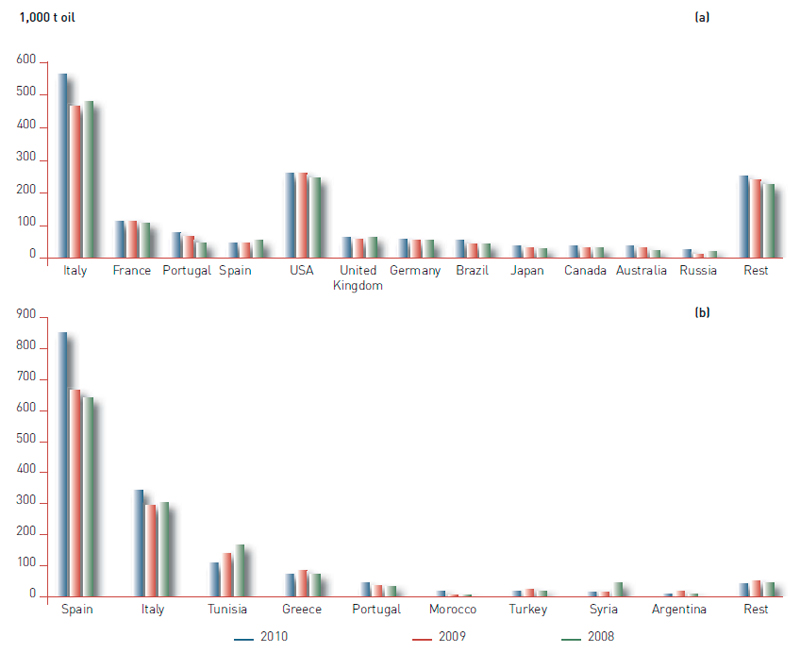

The Mediterranean region has a thriving trade in olive oil, accounting for more than 50% of world imports and 97% of exports. The top destination of Spanish, Greek and Tunisian exports (see Figure 2) is Italy, the world’s leading olive oil importer, which in turn exports a large proportion of this intake. Italy is increasing its direct imports from source countries.

(b) Leading olive oil exporters.

Source: In-house compilation based on FAOSTAT data.

Olive oil production in Spain

Spain is the world’s largest olive growing country, with 24% of the global olive grove surface area and 44% of total oil production. In terms of quality, Spanish oils rank among the best in the world chiefly thanks to the country’s varietal and biological diversity, its rearing and harvest technologies, and the production technologies applied in the oil industry. Almost 400,000 olive farms for oil production generate some 32 million work days a year (slightly more than half of these during the harvest season). Together they cover approximately 2.5 million hectares3, 72% of which are dry-farmed. Irrigated olive farming, mostly dominated by localised techniques, has increased by 50% over the past ten years, contributing to the overall expansion of the olive-growing area, which has seen a 6% growth between 2004 and 2012 despite the contraction of dry-farmed areas.

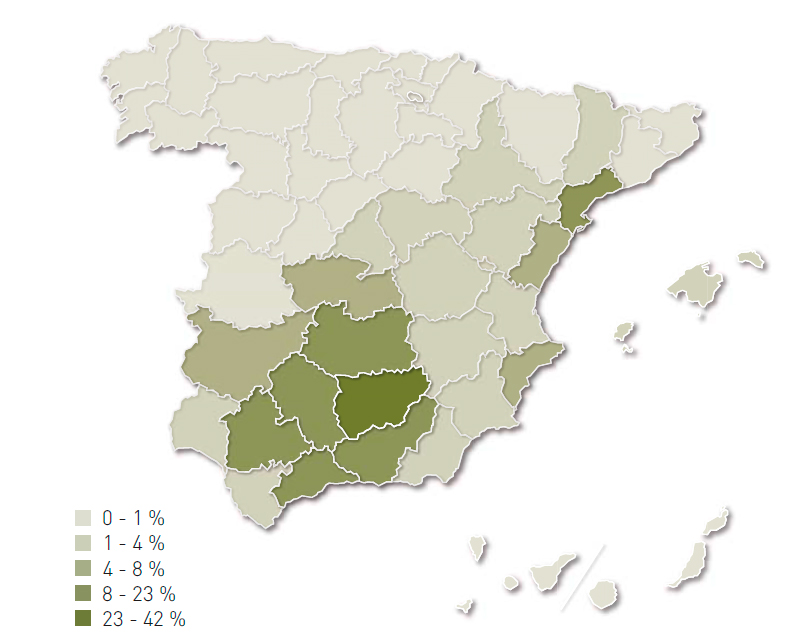

Although olive plantations are found in 13 of Spain’s autonomous regions, Andalusia accounts for 72% of the entire growing surface area and approximately 80% of oil production (see Figure 3).

Source: Ministry for Agriculture, Food and the Environment (MAGRAMA).

Approximately 25% of Spain’s olive-growing surface area is covered by one of the 25 protected designations of origin (PDO) established for virgin olive oil in the country4. However, PDOs have a weak market presence, with sales of PDO oil amounting to a mere 30,000 tonnes.

According to the Olive Oil Agency (AAO)5, a record 1.6 million tonnes of olive oil were produced in Spain in the 2011/2012 season. This growth in production has been attended by an increase in domestic consumption and, most importantly, by the good performance of exports, which reached 874,700 tonnes in the last season (see Figure 4). More than 75% of exports go to EU countries, particularly to Italy (which buys some 50% of all Spanish oil exports), followed by Portugal and France (each taking 10%).

| Season | Production | Domestic consumption (apparent) | Exports |

|---|---|---|---|

| 2008/2009 | 1,030.0 | 533.6 | 675.3 |

| 2009/2010 | 1,401.5 | 533.4 | 780.1 |

| 2010/2011 | 1,391.9 | 553.6 | 828.4 |

| 2011/2012 | 1,615.0 | 569.6 | 874.7 |

Spanish oils and olives

More than 100 different varieties of olives are grown in Spain. While many of these are indigenous, six to eight varieties predominate in one or more regions and take up the bulk of the growing area. The most significant varieties are the following:

- Arbequina: traditionally a Catalan variety, it is also grown in Andalusia, Aragon and Castile-La Mancha.

- Cornicabra: grown in Toledo, Ciudad Real and Madrid.

- Empeltre: produced mainly in Lower Aragon but also in the Balearic Islands, Castellon, Tarragona and Navarre.

- Hojiblanca: grown in Malaga and Cordoba, and to a lesser extent in Seville and Granada.

- Picual: the most widely grown variety, it dominates in Jaen and takes up a large proportion of growing areas in Cordoba and Granada.

- Blanqueta: characteristically grown in Alicante, southern Valencia and Murcia.

- Verdial de Badajoz: mainly grown in Badajoz and Caceres.

Olive oils for direct human consumption are divided into several categories, defined firstly by the system used to obtain the oil, and secondly by their chemical (acidity and other parameters) and organoleptic characteristics (look, feel, smell and taste).

- Virgin olive oil: obtained directly from the

olive using only mechanical means and/

or other physical processes. There are two

categories of virgin olive oil for direct human

consumption:

- Extra virgin olive oil: the highest quality oil. All the health and nutritional properties of this edible fat are kept unadulterated. Maximum free acidity is 0.8 g per 100 g of oleic acid.

- Virgin olive oil: the second-highest quality oil. There are slight alterations of its chemical and/or organoleptic parameters, which prevent classifying this oil as extra virgin. Maximum free acidity is 2 g per 100 g of oleic acid.

- Olive oil6: obtained by blending refined olive oil and virgin or extra virgin olive oil. Maximum free acidity is 1 g per 100 g of oleic acid.

- Olive-pomace oil7: obtained by blending refined olive-pomace oil and virgin or extra virgin olive oil. Maximum free acidity is 1 g per 100 g of oleic acid.

The Spanish olive industry

A number of different players take part in the production and distribution of olive oil, each with its own distinctive role:

- Oil mills. This is where the first industrial processing is carried out to obtain virgin, lampante and pomace oils. These go direct to packaging at the same or a different company if the end product is virgin or extra virgin olive oil. According to the AAO, there are currently 1,750 mills in operation, spread across 13 autonomous regions. Andalusia has the largest number, followed by Castile-La Mancha. While mills vary widely in size, small facilities producing less than 100 tonnes of oil each season prevail. Nonetheless, more than one third of all Spanish oil is turned out from mills producing between 1,000 and 2,500 tonnes, even though they only make up 11% of all facilities. Over 55% of mills are cooperatives, which account for almost 70% of the total oil production.

- Packing plants. There are 1,556 oil packing plants, the vast majority with very small turnovers. Many of them are affiliated to oil mills and package virgin oil only. The 15 largest undertakings, which collectively own 21 plants, account for approximately 70% of the total packed oil output. Most of these are affiliated to refining plants and handle all three types of olive oil, as well as other oils. This group also includes some large-scale packing plants belonging to second-tier8 cooperatives or even to retailers.

- Refineries and pomace extraction plants. This is where oil is refined to correct its deficiencies (high acidity, deficient smell, taste, even colour) and improve its organoleptic characteristics. Crude olivepomace oils are also refined to render them fit for human consumption, as well as seed oils. There are 23 refining plants, most of them handling large turnovers.

- Olive-pomace extraction plants. Crude olive-pomace oil is extracted from the fatty pomace obtained in oil mills. There are currently some 60 extraction undertakings, most of them small family businesses.

According to the AAO, 710,000 tonnes of oil were packed in the 2010/2011 season. The yield available for packing that season was 1,244,000 tonnes, which means that between 50% and 60% of that total was packed.

All the oil sold on the domestic market was packed in Spain, as well as 30% to 35% of oil exports.

In the domestic market, large-scale retailers are the chief channel for the sale of olive oil to private consumers: 88% of total olive oil, 95% of organic olive oil, 88% of virgin olive oil, 86% of extra virgin olive oil, 88% of olive oil and 88% of olive-pomace oil. The restaurant industry also takes up a share of the total, and another goes direct to the food industry. This pattern also prevails in other countries, such as EU consumer states, the US, Canada and Japan, which reveals the strong leverage of the retail sector over the entire production chain.

UE funds for industry modernisation were instrumental in bringing oil mill industrial processes up to date. This resulted in better quality virgin oils, with the ensuing rise in consumption of this range

Currently, many producers export their oils directly, although 15 to 20 companies jointly account for more than 80% of all exports. Exporters include oil refiners, packers, mills and wholesalers. Direct exports by first- and, particularly, second-tier cooperatives have soared since the 1990s, thus boosting their role in the production chain.

The Spanish olive oil industry

Spanish oil industries have grown as a result of the increasing prominence of large retailers in oil sales and the need to boost production volumes in order to gain negotiating leverage. Greater efficiency in foreign markets has also contributed to this expansion. Growth has led to consolidation in the industry, which is fundamentally made up of family businesses and cooperatives. Among the latter, consolidation has mainly come about through the creation and development of second-tier cooperatives, which subsequently become companies with other industry groups. Second-tier cooperatives began proliferating around the 1990s, when they first became direct exporters. It was also at that time that virgin olive oil sales took off at large retailers, leading them to enter into deals directly with oil mills or their second-tier cooperatives in addition to the traditional packing industry, thus giving consumers direct access to cooperative-produced oils.

UE funds for industry modernisation were instrumental in bringing oil mill industrial processes up to date. This resulted in better quality virgin oils, with the ensuing rise in consumption of this range.

Whereas only a few years ago alternate bearing and weather conditions crucially affected crop yields and, consequently, prices, the expansion of irrigation has curbed their effect

The leading Spanish companies own industrial interests in non-European Mediterranean countries. This provides them with a suitable location from which to export to other consuming countries and contributes to make the Mediterranean an increasingly interrelated oil producing region. Large export businesses also have sales networks in destination countries.

Large-scale retailers’ olive oil policies focus on the following areas: sales concentration, which follows from business consolidation in the industry and the decision to centralise procurement at the global level; inclusion of the virgin oil range among the products they offer, a move initially taken only by quality-brandimage producers that subsequently became mainstream; the decision to develop their own brand across the range of oils, which has on the one hand enabled them to purchase virgin oils directly from large packing cooperatives, and on the other hand led to the devaluation of traditionally well-known industrial brands while also putting pressure on prices, an effect that has increased dramatically with the economic crisis, even if it was already being felt before its onset.

The players in the production chain have reacted by consolidating to improve their negotiating leverage, expanding their range to take in all categories of oil, and seizing direct access to exports to derive greater value from this trade channel. They have also been compelled to adjust their costs.

A number of reasons have been suggested to explain the low penetration of this kind of insurance, including olive trees’ lower exposure to weather-related risks compared with other trees such as fruit trees, and their alternate bearing nature, which means growers are accustomed to having low-yield years

The economic crisis that began in 2007 has impinged on the oil production chain for a number of reasons: the fall in consumption of higher-priced products; large retailers’ pressure on prices, which affects the entire chain; the growth of large retailers’ own brands, which weakens the negotiating leverage of popular brands; the growth of discount outlets, restricting access to the end market for some higher-value products; lending restrictions, which bear on stock maintenance; and the rising cost of petroleum oil. All these factors have reinforced the trends that were already taking shape in terms of business consolidation and the increasing weight of large retailers in price formation.

Risk in the olive oil industry

Pathogens and weather-or climate- related disasters are, along with the olive tree’s alternate bearing nature9, the factors most strongly affecting the stability of olive crops.

Unless they are efficiently controlled, pests and diseases can bring substantial financial loss to olive-growing undertakings as they reduce yields and sometimes affect oil quality. In Spain, the two most significant pests are the olive fly (Bactrocera oleae), which affects olive yields and oil quality, and the olive moth (Prays oleae). The most notable diseases are the olive leaf blotch and, to a lesser extent, olive anthrachnose -also known in Spain as soapy fruit or leprosy- and verticillium wilt, which chiefly affects young plantations. Although chemical control is the most widely used defence system in Spanish farms, integrated control10 has grown significantly in recent years.

Climate and weather conditions are potential direct causes of crop losses and often favour the development of diseases and attacks by certain types of pests. Occasionally, they also damage the trees themselves. Among the climatic conditions that generate the heaviest losses in Spain, drought is foremost, followed by hail, torrential rain and frost. The Spanish agricultural insurance system (Agroseguro) offers olive growers an increasing-cover programme that protects farms against weather-related risks including hail, torrential rain, drought and gale-force winds, as well as non-weather-related risks such as wildlife and fire. This programme covers not only production losses but also damage to plantations and irrigation systems where these are used. Growers can choose between three schemes, each providing different cover levels, on the basis of the needs and nature of their farms. The prevalence of the increasing cover programme is currently limited, with only 7% of the growing area and 10% of the olive production being covered.

A number of reasons have been suggested to explain the low penetration of this kind of insurance, including olive trees’ lower exposure to weather-related risks compared with other trees such as fruit trees, and their alternate bearing nature, which means growers are accustomed to having low-yield years.

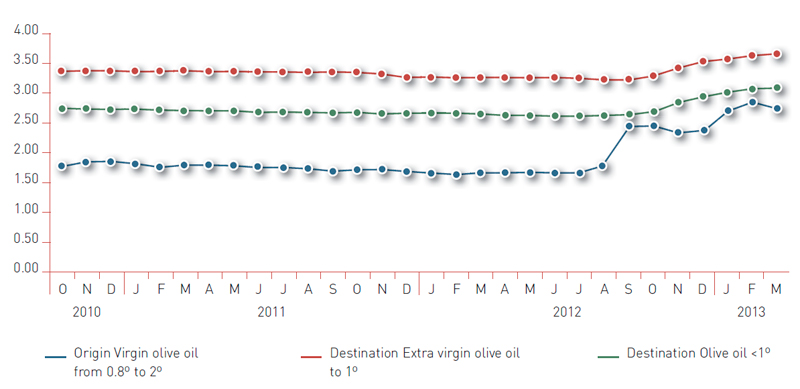

Market prices represent a further key risk to profitability in the olive oil industry. Oil prices at the place of origin chiefly reflect fluctuations in consumption, exports, stocks, production in the current season and prospects for the next. Whereas only a few years ago alternate bearing and weather conditions crucially affected crop yields and consequently, prices, the expansion of irrigation has curbed their effect.

Bulk produce trade is highly dynamic, particularly among Mediterranean countries. Hence, where whole olives are concerned, the aggregate production for the region must be considered. The global olive oil market is a small one, particularly compared with other oils and oilseeds such as soy or rape. Accordingly, financial movements in commodity markets have a weaker impact than on other products.

Price variations at destination are not as wide as at the place of origin, similarly to any other product. This indicates that part of the fluctuation is absorbed throughout the value chain (see Figure 5).

Source: MAGRAMA and State Secretariat for Trade.

Future prospects

For now, the increase in consumption is absorbing the expanding olive-growing surface area and production. This long-standing trend does not seem about to change, unless an enduring economic crisis causes consumption to drop significantly in Europe.

Production is expected to continue rising, driven firstly by the expansion of growing surface areas in non-EU countries and secondly by the increasing use of irrigation in EU Mediterranean countries. The Mediterranean region and particularly EU countries may lose weight, although they will continue to be in a position of hegemony, bolstered by the power of their companies.

It also seems likely that business consolidation will continue throughout the chain, at least across the Mediterranean region, and that large-scale retailers will continue to be the hegemonic player in price formation.

Support to local markets and reduced-scope marketing mechanisms may help to drive sales at this level, an important objective in olive producing regions. Online sales are also expected to climb. On the other hand, economic difficulties may drive consumption down in the restaurant industry, a buyer that players in the olive sector rely on as an alternative to large retailers.

1 FAOSTAT: http://faostat.fao.org Statistics Division of the Food and Agriculture Organization of the United Nations.

2 IOC: http://www. internationaloliveoil.org International Olive Oil Council.

3 According to the MAGRAMA’s Crop Yield and Surface Survey (ESYRCE), a total of 2,506,830 ha were planted with olives for oil production or for oil-andtable production in 2012, 694,830 ha of which were irrigated.

4 In addition to the existing 25 PDOs, a further five are in the process of registration with the EU register.

5 AAO: Olive Oil Agency of the MAGRAMA.

6 Obtained by refining virgin olive oil. Maximum free acidity is 0.3 g per 100 g of oleic acid. These oils are devoid of taste and odour.

7 Olive pomace is a fatty by-product (skin residue, stones) obtained in the virgin oil production process. The oil contained in the pomace is extracted in dedicated extraction plants using solvent treatment or physical means.

8 Under the Spanish Law on Cooperatives, second-tier cooperatives are legal entities incorporated by a minimum of two cooperatives. Other public or private entities and individual entrepreneurs can also hold an interest in them up to a maximum of 45% of all partners.

9 Alternate bearing is a characteristic of olive trees whereby yields are high one year and low the next. Certain techniques can be used to mitigate its effects, including pruning, irrigation and crop thinning.

10 Directive 91/414/ EEC defines integrated control as “the rational application of a combination of biological, biotechnological, chemical, cultural or plant-breeding measures whereby the use of chemical plant protection products is limited to the strict minimum necessary to maintain the pest population at levels below those causing economically unacceptable damage or loss”.