What is driving the rising cost of natural disasters?Natural Perils

Prof. John McAneney

Managing Director

Dr. Ryan Crompton

Chief Research Officer

Risk Frontiers

Macquarie University

Australia

It is a widely held view that climate change arising from human activity is increasing the cost of natural disasters. This perception is false. While it is undeniable that the economic cost of natural disasters is rising rapidly, it is doing so because of growing concentrations of population and wealth in disaster-prone regions. So far studies of long-term insurance or economic disaster loss histories caused by extreme weather -tropical cyclones, floods, bushfires (wildfires) and storms- have been unable to identify a contribution from human-induced climate change. This is true for many different natural perils and across jurisdictions.

Given the inter-annual variance of natural disaster losses, identifying a climate change contribution with statistical confidence faces a formidable signal-to-noise problem. At least in respect to US tropical cyclone losses and based on current climate change projections, the emergence timescale has been shown to be of the order of many decades to centuries.

(The emergence timescale is the time taken for a climate change contribution to the losses to emerge with high statistical confidence). This being the case and in the absence of scientific clarity, decisions relating to climate change will have to be made in a climate of uncertainty and ignorance.

The uncertainty about actual outcomes of a warmer climate in terms of extreme weather and property damage strengthens the case for increased investment in disaster risk reduction for its own right, and as part of climate change adaptation policies. Risk-informed land use planning practices, hazard resilient building codes and defence measures such as flood levees hold the key but their implementation will require unpopular political decisions. Without such efforts the cost of natural disasters will continue to rise. Insurers have the benefit of being able to update their views of risk every 1-2 years, and so climate change should not be a main concern for the industry as long as underwriters understand company exposures, and price risks accordingly. Over time, good underwriting practice can send a strong message to government and homeowners to encourage risk-reducing behaviours.

Introduction

The increase in natural disaster losses has led to concerns that anthropogenic climate change is contributing to this trend. (By anthropogenic climate change we mean changes in climate arising from human activity.) Many peer-reviewed studies have examined this issue and our paper summarises these as well as more recent efforts to estimate the timescale at which an anthropogenic climate change signal might be detectable in US hurricane loss data. Perils of concern here are those likely to cause damage to property assets, in particular tropical cyclones, storms including hailstorms, floods and bush (wild) fires. US hurricanes warrant special attention because of:

- their impact on the global insurance market through the supply of and demand for reinsurance;

- the availability of long-term normalised economic loss history from landfalling hurricanes; and

- high quality modelling of the impact of anthropogenic warming on basin-wide hurricane activity.

We conclude with some brief observations about how to address the challenge of the rising toll of natural disasters and the vulnerability of insurers to climate change.

Loss normalisation studies

Loss normalisation

Before apples-with-apples comparisons can be made between the impacts of past and more recent natural hazard loss events, changes in various societal factors known to influence the magnitude of losses must first be accounted for. Climate-related influences stem from changes in the frequency and/or intensity of natural perils whereas socioeconomic factors comprise changes in the vulnerability and exposure to the natural hazard. Adjustment for the latter (nonclimate-related) factors has become known as loss normalisation (Pielke and Landsea 1998); it attempts to answer the question: what would be the losses if historic events were to recur under current societal conditions? We begin by examining some Australian studies.

Australian studies

Crompton and McAneney (2008) normalised Australian weather-related insured losses over the period 1967-2006 to 2006 values. Loss data obtained from the Insurance Council of Australia (ICA)1 were adjusted for changes in dwelling numbers and nominal dwelling values (excluding land value) since the time of the original event. In a marked departure from previous normalisation studies, the authors also applied an additional adjustment for tropical cyclone losses to account for improvements in construction standards mandated for new construction in tropical cyclone-prone parts of the country (Mason et al. 2013). The success of improved building standards in reducing losses has been demonstrated repeatedly in more recent events.

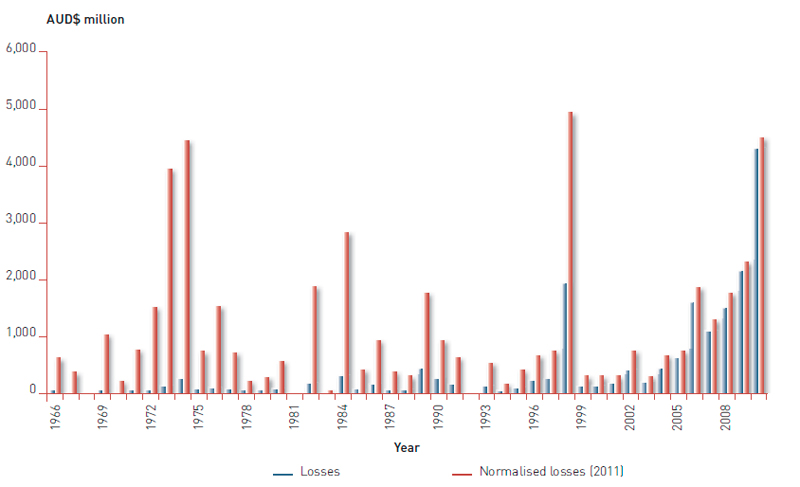

Figure 1 shows the annual aggregate losses and the annual aggregate normalised losses (2011/12 values) for weather-related events in the ICA Disaster List. These figures are updated from those of Crompton and McAneney (2008) using a more refined methodology described in Crompton (2011). Importantly, no trend is evident in the normalised losses (Figure 1 red), implying that socio-economic factors are sufficient to explain the increase in the cost of insurance sector losses (Figure 1 blue). In other words, it is not possible to detect an anthropogenic climate change signal once losses are normalised. We note that despite record high 2012/13 summer air temperatures across Australia, industry losses for the most recent financial year -1 July 2012 to 30 June 2013- are very close to the longterm average normalised loss of AUD 1.1 billion.

Source: Crompton (2011).

Adjustment for vulnerability and exposure to natural hazards has become known as loss normalisation (Pielke and Landsea 1998); it attempts to answer the question: what would be the losses if historic events were to recur under current societal conditions?

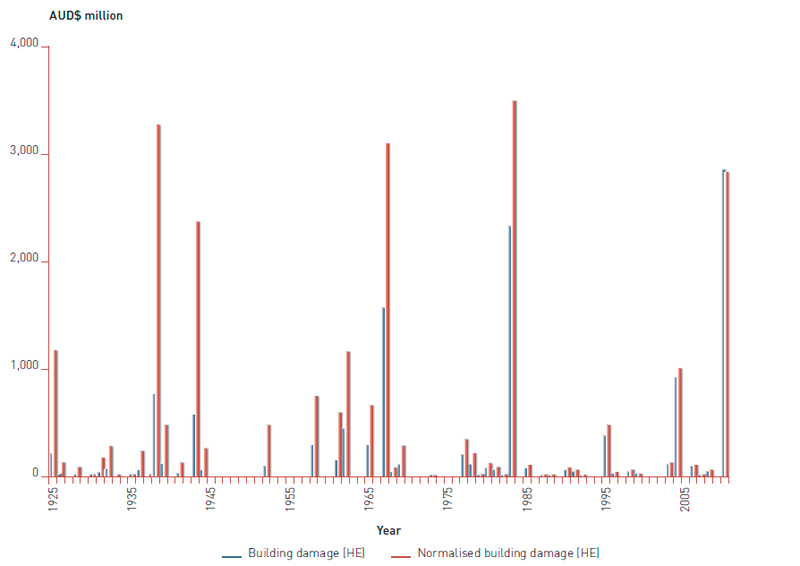

Many readers might imagine bushfire losses to be more sensitive to increasing air temperatures than some other perils. However, at least in Australia, it is still not possible to detect an anthropogenic signal in normalised loss data. Following the large loss of life and building damage incurred in the 2009 bushfires in Victoria, Australia, Crompton et al. (2010) examined the history of fatalities and building damage since 1925. Figure 2 shows the actual and normalised building damage expressed in numbers of residential homes destroyed. Once the building damage is adjusted for increases in dwelling numbers, no residual trend was found that might be attributed to anthropogenic climate change, or other factors for that matter.

Source: Crompton et al., 2010.

Global studies

Bouwer (2011) provides a comprehensive review of loss normalisation studies. Key conclusions to emerge from the 21 weather-related disaster loss studies examined, including the Australian studies discussed above, are that while economic losses have increased around the globe, no trends in losses adjusted for changes in population, wealth and inflation (or proxies for these factors) can be attributed to anthropogenic climate change.

Studies published since Bouwer’s review provide yet further support for his findings. For example, Neumayer and Barthel (2011) at the London School of Economics found substantial increases in economic losses from natural disasters during 1980-2009 but no significant upward trends once these losses were normalised. Importantly, and echoing many other studies, Barthel and Neumayer (2012) conclude:

Climate change neither is nor should be the main concern for the insurance industry. Accumulation of wealth in disaster prone areas is and will always remain by far the most important driver of future economic disaster damage.

Other recent analyses to report no anthropogenic climate change influence on normalised losses include: Zhang et al. (2011) -tropical cyclone economic losses in China; Barredo et al. (2012)- insured losses from floods in Spain, and Simmons et al. (2012) – US tornado economic damage.

In line with the peer-reviewed literature, the Special Report of the Intergovernmental Panel on Climate Change (IPCC) ‘Managing the Risks of Extreme Events and Disasters to Advance Climate Change Adaptation’ (SREX) (IPCC 2012) supports the findings previously discussed:

Increasing exposure of people and economic assets has been the major cause of long-term increases in economic losses from weather-and climate-related disasters (high confidence) (IPCC 2012).

Thus while a role for anthropogenic climate change cannot be categorically ruled out, research to date is yet to detect or attribute an anthropogenic influence on disaster losses, despite widespread assertions to the contrary. The anthropogenic signal in Climate Change, if it exists, is dwarfed by the overwhelming contribution of more assets being built in harm’s way and the large year-to-year variation in impacts.

The anthropogenic signal in Climate Change, if it exists, is dwarfed by the overwhelming contribution of more assets being built in harm’s way and the large year-to-year variation in impacts

Other relevant studies

Although not normalisation studies per se, research by Di Baldassarre et al. (2010), van der Vink et al. (1998), Weinkle et al. (2012) and Chen et al. (2009) all point to societal factors being the driving forces behind rising disaster losses. For example, Di Baldassarre et al. (2010) found that:

… the intensive and unplanned urbanization in Africa and the related increase of people living in floodplains has led to an increase in the potential adverse consequences of floods and, in particular, … the loss of human lives ... It can be seen that most of the recent deadly floods have happened where the population has increased more.

Much earlier van der Vink et al. (1998) had concluded that the US was becoming more vulnerable to natural disasters because more property was being placed in harm’s way:

In many ways the trends [in losses] seem paradoxical. After all, most natural disasters occur in areas of known high risk such as barrier islands, flood plains, and fault lines. Over time, one would expect that the costs of natural disasters would create economic pressures to encourage responsible land use in such areas. And while there will always be great political pressure to provide economic relief after a disaster, there has been little political interest in requiring pre-disaster mitigation.

These perceptive observations certainly ring true in the Australian context.

Timescale at which an anthropogenic climate change signal might be observed in US tropical cyclone loss data

Despite no anthropogenic climate change influence having yet been detected in normalised weather-related disaster losses, we would be naïve to imagine that this will not happen at some point in the future. This being the case, Crompton et al. (2011) asked the following question in respect to US hurricanes: if changes in storm characteristics occur as projected, then on what timescale might we expect to detect the effects of those changes in economic loss data with some scientific certainty, say with 95% confidence?

The point of departure for Crompton et al. (2011) was projections of future Atlantic basin hurricane activity from the NOAA Geophysical Fluid Dynamics Laboratory (Bender et al. 2010). Combining these with the Pielke et al. (2008) normalised loss data, a bootstrapping analysis showed anthropogenic signals to emerge at time scales of between 120 and 550 years. This range of outcomes derives from using different Global Climate Models to set the boundary conditions for the downscaling. It took 260 years for an 18-model ensemblebased signal to emerge.

Emanuel (2011) and Crompton (2011) results also argue very strongly against using abnormally large losses from individual Atlantic hurricanes or seasons as evidence of anthropogenic climate change

Emanuel (2011) implemented an alternative methodology to Crompton et al. (2011). He looked at four different models, three of which showed increasing losses and one a small decrease. Of the three models that showed increasing losses, time until detection was estimated to be 40, 113 and 170 years. These emergence timescales are shorter than those determined by Crompton et al. (2011), but regardless of these differences, both studies agree that the time to detection will be a very long time, perhaps centuries. Their results also argue very strongly against using abnormally large losses from individual Atlantic hurricanes or seasons as evidence of anthropogenic climate change.

The disaster mitigation challenge

Recent catastrophes have highlighted many challenges, including how best to organise systems to pay for the damage caused by natural disasters. Insurance (public and private) plays a critical role in providing funds for economic recovery after a catastrophe. But insurance is a means of transferring risks from individuals to companies (insurers) with a broader diversification capacity: simply purchasing insurance will not reduce risk.

When we look to ways to address the increasing trend in losses it is impossible to overlook the decisive role that poor land use planning has played in recent disasters. We give just two examples from Australia: the loss of life and buildings in the 2009 Victorian bushfires, and the 2011 Brisbane floods. In the first case, work undertaken by Risk Frontiers for the Royal Commission (Chen and McAneney 2010; Crompton et al. 2010) showed a large proportion of buildings destroyed either lay within bushland, or at very small distances from it. In fact, 25% of destroyed homes were situated within 1 m of the bush and so were effectively part of the fuel load. The destruction was not surprising and points to a marked failure of land-use planning in what is often referred to as “the most bushfire-prone part of the planet”.

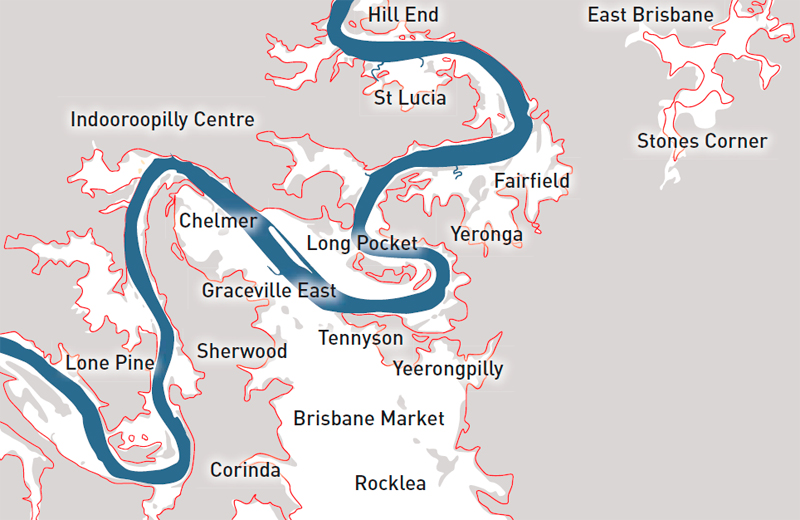

Similar observations can be made about the 2011 Brisbane floods. This event, which combined with other associated flooding in the state of Queensland during the summer of 2010/11, heavily impacted the national economy. The estimated economic loss was some AUD$6 billion. The losses led to the introduction of a flood levy, a temporary reconstruction tax. The Brisbane flooding had a footprint very similar to that of the 1974 floods (Figure 3), and no doubt that of much bigger floods recorded in the 1800’s. However the area is now much more heavily developed than was the case in 1974 with the Brisbane City Council approving 1,811 additional development applications just since 2005 (K. Doss, City Planning & Economic Development, pers. com.).

Source: Van den Honert and McAneney (2011).

Disaster mitigation measures can offset some of the upward pressure demographic and economic drivers exert on natural disaster losses. In a study for the Australian Building Codes Board, McAneney et al. (2007) estimated that the introduction of building code regulations requiring houses to be structurally designed to resist wind loads had reduced average annual property losses from tropical cyclones in Australia by some two-thirds. Their estimate was based on a comparison of likely losses assuming that either

- the building code regulations had never been implemented, i.e. we were still building residential homes as we were prior to the mid-1970’s, or

- the regulations had they always been in place.

Regulatory efforts to limit premium increases in high risk areas, as has occurred in some parts of the US, can diminish the insurance system’s ability to perform this function (McAneney et al. 2013)

Without regulation, the challenge lies in encouraging residents in hazard-prone areas to invest in mitigation measures. It is a common observation that despite the reductions in risk that could be achieved, many homeowners, private businesses, and public-sector organisations fail to voluntarily adopt cost-effective loss-reduction measures. This theme was echoed in surveys of victims of the 2011 Queensland and Victorian floods: many of these indicated a preference to use money from state and federal disaster relief or insurance to build back in the same manner as before the floods and with no thought of reducing future risk (Bird et al. 2012).

Ideally the insurance sector can play an important role in providing incentives for loss mitigation by sending price signals reflecting risk. However regulatory efforts to limit premium increases in high risk areas, as has occurred in some parts of the US, can diminish the insurance system’s ability to perform this function (McAneney et al. 2013).

Conclusions

Studies of the economic impacts arising from natural disasters in many parts of the globe have concluded that the main drivers of the increasing costs are demonstrably socio-economic factors. Contrary to popular opinion, no peer-reviewed study has yet been able to detect an anthropogenic climate change influence on the losses.

While this does not rule out an anthropogenic influence, it does suggest that its influence, if any, is currently negligible in the face of large societal changes and the year-to-year variation in the impacts. And in the particular case of US tropical cyclone losses, it will be a very long time before its influence becomes detectable, perhaps even centuries. As far as disaster losses are concerned, this does not imply that the likely effects of anthropogenic climate change should be ignored, rather that decisions made in respect to adaptation will of necessity need to take place in an environment of considerable uncertainty and ignorance. But returning to the central point of this paper, blaming climate change for large natural disaster losses is to overlook the primary causes of these losses, in particular, poor land-use planning practices.

While it is difficult to influence the likelihood of extreme weather events, i.e. the hazard, we have control over where and how we build

So what can we do? While it is difficult to influence the likelihood of extreme weather events, i.e. the hazard, we have control over where and how we build. The success of regulated improvements to residential construction in cyclone-prone parts of Australia shows what can be achieved with political will. And any actions that help society adapt to the current climate variability will alleviate the impact under any future climate.

In conclusion, it is unlikely that insurers will be materially threatened by anthropogenic climate change. However insurers can play an important role by pricing risks accordingly thereby sending clear price signals to homeowners and governments to encourage risk-reducing behaviours.

References

- Barredo, J. I., D. Saurí y M. C. Llasat, 2012. “Assessing Trends in Insured Losses From Floods in Spain 1971-2008”, en Nat. Hazards Earth Syst. Sci., 12, 1723-1729. [www.nat-hazards-earthsyst- sci.net/12/1723/2012/nhess-12-1723-2012.html].

- Barthel, F. y E. Neumayer, 2012. “A Trend Analysis of Normalized Insured Damage From Natural Disasters”, en Clim. Change, 113, 215-237.

- Bender, M. A., T. R. Knutson, R. E. Tuleya, J. J. Sirutis, G. A. Vecchi, S. T. Garner e I. M. Held, 2010. “Modeled Impact of Anthropogenic Warming on the Frequency of Intense Atlantic Hurricanes”, en Science, 327, 454-458.

- Bird, D., D. King, K. Haynes, P. Box, T. Okada y K. Nairn, 2012. Impact of the 2010/11 Floods and the Factors That Inhibit and Enable Household Adaptation Strategies. Informe para el National Climate Change Adaptation Research Facility (NCCARF), Gold Coast, Australia.

- Bouwer, L. M., 2011. “Have Disaster Losses Increased Due to Anthropogenic Climate Change?”, en Bull. Amer. Meteorol. Soc., 92, 39-46.

- Chen, K., J. McAneney y K. Cheung, 2009. “Quantifying Changes of Wind Speed Distributions in The Historical Record of Atlantic Tropical Cyclones”, en Nat. Hazards Earth Syst. Sci., 9, 1749-1757. [www.nat-hazards-earth-syst-sci.net/9/1749/2009/ nhess-9-1749-2009.html].

- Chen, K. y J. McAneney, 2010. Bushfire Penetration Into Urban Areas in Australia: A Spatial Analysis. Informe invitado elaborado para la Comisión Real sobre el incendio forestal de Victoria en 2009. Risk Frontiers.

- Crompton, R. P., 2011. Normalising the Insurance Council of Australia

Natural Disaster Event List: 1967–2011. Informe elaborado

para el Insurance Council of Australia (ICA), Risk Frontiers.

[http://www.insurancecouncil.com.au/assets/files/normalising%20the%20insurance%20council%20of%20

australia%20natural%20disaster%20event%20list.pdf]. - Crompton, R. P. y K. J. McAneney, 2008. “Normalised Australian Insured Losses From Meteorological Hazards: 1967-2006”, en Environ. Sci. Policy, 11, 371-378.

- Crompton, R. P., K. J. McAneney, K. Chen, R. A. Pielke Jr. y K. Haynes, 2010. “Influence of Location, Population, and Climate on Building Damage and Fatalities Due To Australian Bushfire: 1925-2009”, en Wea. Climate Soc., 2, 300-310.

- Crompton, R. P., R. A. Pielke Jr. y K. J. McAneney, 2011. “Emergence Timescales for Detection of Anthropogenic Climate Change in US Tropical Cyclone Loss Data”, en Environ. Res. Lett., 6, 4 p. [http://iopscience.iop.org/1748- 9326/6/1/014003].

- Di Baldassarre, G., A. Montanari, H. Lins, D. Koutsoyiannis, L. Brandimarte y G. Blöschl, 2010. “Flood Fatalities in Africa: From Diagnosis to Mitigation”, en Geophys. Res. Lett., 37, L22402, doi:10.1029/2010GL045467.

- Emanuel, K., 2011. “Global Warming Effects on U.S. Hurricane Damage”, en Wea. Climate Soc., 3, 261-268.

- IPCC, 2012. Managing the Risks of Extreme Events and Disasters to Advance Climate Change Adaptation. Informe especial de los Grupos de trabajo I y II del Grupo Intergubernamental de Expertos sobre el Cambio Climático [Field, C. B., V. Barros, T. F. Stocker, D. Qin, D. J. Dokken, K. L. Ebi, M. D. Mastrandrea, K. J. Mach, G.-K. Plattner, S. K. Allen, M. Tignor y P. M. Midgley (eds.)]. Cambridge University Press, Cambridge, Reino Unido, y Nueva York, Estados Unidos, 582 p.

- Mason, M., K. Haynes y G. Walker (en prensa). “Cyclone Tracy and the Road to Improved Wind Resistant Design”, en Natural Disasters and Adaptation to Climate Change, Eds. Palutikof, J., D. Karoly, y S. Boulter, Cambridge University Press.

- McAneney, J., R. Crompton y L. Coates, 2007. Financial Benefits Arising From Regulated Wind Loading Construction Standards in Tropical-Cyclone Prone Areas of Australia. Informe elaborado para el Australian Building Codes Board), Risk Frontiers, Australia. [http://www.riskfrontiers.com/publicationgraphics/ ABCB_TC_revised.pdf].

- McAneney, J., R. Crompton, D. McAneney, R. Musulin, G. Walker y R. Pielke Jr, 2013. Market-Based Mechanisms for Climate Change Adaptation: Assessing the Potential for and Limits to Insurance and Market-Based Mechanisms for Encouraging Climate Change Adaptation. National Climate Change Adaptation Climate Change Facility, Gold Coast, 100 p. [http://www.riskfrontiers.com].

- Neumayer, E. y F. Barthel, 2011. “Normalizing Economic Losses from Natural Disasters: A Global Analysis”, en Global Environ. Change, 21, 13-24.

- Pielke Jr., R. A. y C. W. Landsea. 1998. “Normalized Hurricane Damages in The United States: 1925-95”, en Weather Forecast., 13, 621-631.

- Pielke Jr., R. A., J. Gratz, C. W. Landsea, D. Collins, M. Saunders y R. Musulin, 2008. “Normalized Hurricane Damage in The United States: 1900-2005”, en Nat. Hazards Rev., 9, 29-42.

- Simmons, K. M., D. Sutter, y R. A. Pielke Jr., 2012. “Normalized Tornado Damage in The United States: 1950-2011”, en Environ. Hazards, doi: 10.1080/17477891.2012.738642.

- Van den Honert, R. y J. McAneney, 2011. “The 2011 Brisbane floods: Causes, impacts and implications”, en Water, 3, 1149-1173.

- Van der Vink, G., R. M. Allen, J. Chapin, M. Crooks, M. Fraley, J. Krantz, A. M. Lavigne, L. LeCuyer, E. K. MacColl, W. J. Morgan, B. Ries, E. Robinson, K. Rodriguez, M. Smith y K. Sponberg, 1998. “Why The United States is Becoming More Vulnerable to Natural Disasters”, en EOS, Transactions, American Geophysical Union, 79, 533–537.

- Weinkle, J., R. Maue y R. Pielke, 2012. “Historical Global Tropical Cyclone Landfalls”, en J. Climate, 25, 4729-4735.

- Zhang, J., L. Wu y Q. Zhang, 2011. “Tropical Cyclone Damages In China Under The Background Of Global Warming”, en J. Trop. Meteorol. (en chino).