The Great East Japan Earthquake: March 11 and BeyondNatural Perils

Tadashi Baba

Managing Director

Japan Earthquake Reinsurance Co. Ltd. (JER)

Tokyo - Japan

Introduction

On March 11, 2011, a massive 9.0-magnitude earthquake struck off the coast of northeast Japan, approximately 130 km east of Sendai and 373 km northeast of Tokyo. The earthquake, the largest ever recorded in Japan, triggered powerful tsunami waves that reached heights of up to 10 meters in the hardest-hit Miyagi prefecture. A total of 15,883 people lost their lives in the enormous earthquake and ensuing tsunami. Even now, 2,654 people are unaccounted for, 286,006 people remain displaced, most of them staying with relatives or in public or temporary housing (as of September 12, 2013).

Three years have passed since then. In this document we review the way in which the Japanese Non-Life insurance industry has handled this catastrophe and take a closer look at Japan’s future earthquake insurance system.

Japan’s Earthquake Insurance System

Providing monetary support for victims of earthquakes and other disasters was the reason that moved the Japanese Government to establish earthquake insurance for dwelling risks on May 18, 1966, as part of the Law on earthquake insurance.

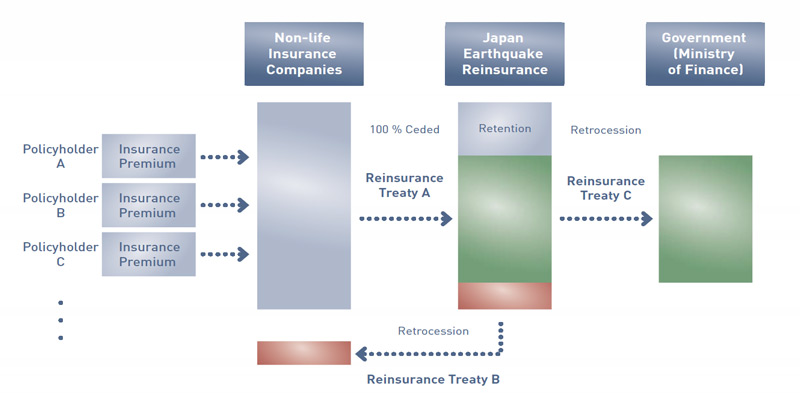

Homeowners’ exposure to earthquake risks falls under this earthquake insurance system. Risks are shared by the Government, Non-Life insurance companies and Japan Earthquake Reinsurance (JER), which is jointly owned by 11 private insurers. The system has a total claims limit of 6,200 billion yen, fully retained within Japan and not ceded overseas. The reinsurance scheme is reviewed every year and its revision is subject to the approval of the National Diet.

The industry’s management of the situation

In response to this devastating disaster, the Non-Life insurance industry and the Government joined forces to take measures aimed at ensuring the prompt, steady payment of insurance claims, so that policyholders in the affected areas would receive the necessary support to rebuild their lives.

Initiatives taken by GIAJ and its member insurers

Following the established master plan, the General Insurance Association of Japan (GIAJ) set up an “Earthquake Insurance Central Command” in Tokyo and an “Earthquake Insurance Local Headquarters” in Sendai on March 11, 2011. Claims processing proved much more efficient on this occasion than during the Great Hanshin-Awaji Earthquake in 1995, particularly in terms of the smoothness of operations.

Providing monetary support for victims of earthquakes and other disasters was the reason that moved the Japanese Government to establish earthquake insurance for dwelling risks on May 18, 1966, as part of the Law on earthquake insurance

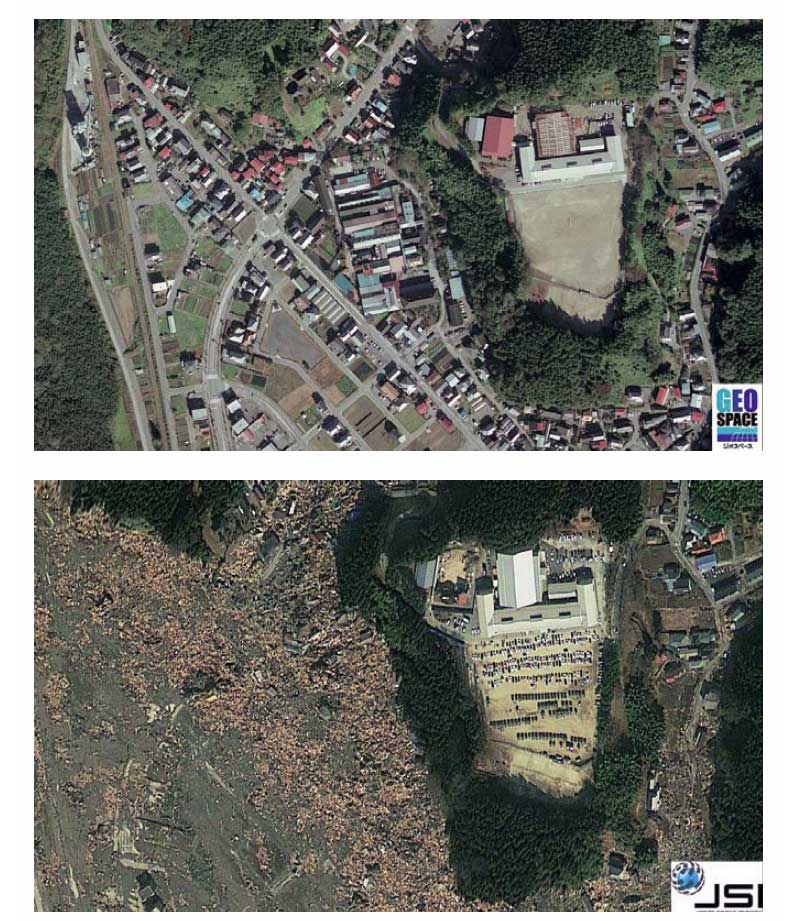

As the tsunami and fires caused losses across large areas of the coastal region in Iwate, Miyagi and Fukushima prefectures, all the insurers carried out a joint loss survey and used the same claim form, in what amounted to an industry first. Preset standard guidelines for the classification of tsunami and liquefaction damage were also used, with the necessary adjustments to enable prompt assessment of the situation. Further efforts included sharing contract lists among all insurers and identifying “total loss areas” -i.e. areas that had been completely wiped out by earthquake and tsunami- with the aid of aerial and satellite pictures.

GIAJ set up a free telephone hotline and a website where policyholders could ask which insurer they had bought earthquake insurance from. Insurers also made regular visits to evacuation centers to deliver more information on earthquake insurance claim procedures and provide advice services. A grace period for policy renewal and premium payment was also granted.

GIAJ has conducted several campaigns to inform policyholders on how to make their earthquake insurance claims. These include Policyholder television, radio and newspaper advertisements and internet announcements, as well as posters and brochures distributed throughout the affected areas.

KOKUSAI KOGYO Co., Ltd.

Special care was taken to simplify procedures in insurance claims made on behalf of people who were deceased or physically unable to deal with the formalities. Signature and seal requirements for claim payments were also waived off, and copies of family register certificates were obtained directly from the Government.

Initiatives taken by JER

JER’s mission in the face of major disaster is to financially facilitate the prompt payment of insurance claims by Non-Life insurance companies by providing reinsurance payments, with the ultimate aim of enabling policyholders in the affected areas to rebuild their lives in the shortest possible time.

JER’s mission in the face of major disaster is to financially facilitate the prompt payment of insurance claims by Non-Life insurance companies by providing reinsurance payments

Following this disaster, JER made reinsurance payments based on approximate projections, for the first time since the establishment of Japan’s earthquake insurance system. This is a system in which estimated reinsurance payments are based on rough projections of the amount of damage caused by the earthquake. The system is designed to make it possible to provide the funds necessary for reinsurance payment to Non-Life insurance companies in advance, before they pay insurance claims to policyholders affected by an earthquake. Thus, JER set about liquidating assets as necessary to meet these estimated payments. We secured approximately 322.4 billion yen in cash by selling assets within 20 days of the occurrence of the earthquake (March 31, 2011), and received a reinsurance payment of approximately 426.8 billion yen based on approximate Government projections within 73 days of the occurrence of the earthquake (May 23, 2011). A total of four series of payments to Non- Life insurance companies were eventually made by JER starting on April 20, 2011 amounting to a total of 968.6 billion yen, with the last payment being made on May 25, 2011.

Reviewing the System

By the end of May 2012, the Japanese Non-Life insurance industry had made insurance claim payments of 1,234.6 billion yen in respect of 783,648 cases. Thus, the earthquake insurance risk reserve had almost halved from 2,381.9 billion yen to 1,280.8 billion yen at the end of March 2012.

Further efforts included sharing contract lists among all insurers and identifying “total loss areas” -i.e. areas that had been completely wiped out by earthquake and tsunami- with the aid of aerial and satellite pictures

In these circumstances, the Ministry of Finance created a task force on April 23, 2012 to review the current earthquake insurance system. The group was comprised of 13 members, who were mainly chosen from the academic community. Based on its discussions in twelve meetings, the task force published a report on the future earthquake insurance system on November 30, 2012. This report grouped the system’s shortcomings into three types: “Urgent Issues”, “Issues that should be promptly addressed (Medium-term Issues)” and “Issues that should be discussed continuously (Long-term issues)”. The system’s strength, to which the Non-Life insurance industry was the most closely related, was considered an urgent issue.

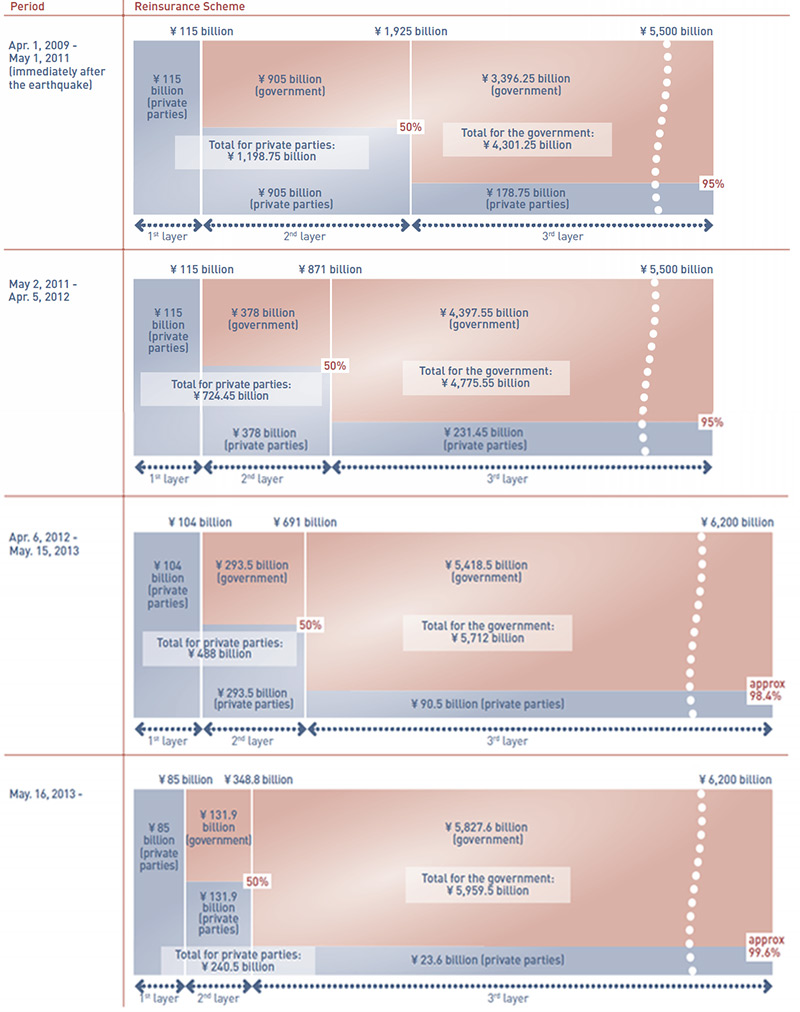

The Great East Japan Earthquake prompted a review of the reinsurance layer scheme with effect from May 2, 2011, and a significant reduction in the amount of private insurers’ liability by means of a supplementary budget which took into consideration the substantial fall in the private risk reserve. However, it took about one and a half months for the supplementary budget bill to pass through the Diet. In view of this, to prevent private insurers from bearing excessive liability in the event of more than one earthquake occurring in succession, the report proposed introducing a layer revision bridge measure for the period between the occurrence of a massive earthquake and the early adoption of a supplementary budget. Specifically, the report recommended either reducing private liability automatically without the Diet approval in cases where the private risk reserve has shrunk substantially as a result of the first earthquake (an automatic layer revision plan), or setting private liability lower than the initial level of the risk reserve and giving Non-Life insurance companies and JER the additional resources necessary to deal with the second earthquake (a buffer plan). After consideration of the above two proposals, the Government adopted the buffer plan in its 2013 fiscal budget bill (which passed through the Diet on May 15, 2013) and took steps to significantly reduce the amount of private liability.

Related Response

The Great East Japan Earthquake also made a great impact on other parties related to the earthquake insurance system.

Following the lessons learned from this disaster, the Government founded the Headquarters for Earthquake Research Promotion in July 1995 as part of the Special Measures Law on Earthquake Disaster Prevention

The Great Hanshin-Awaji Earthquake disaster of January 17, 1995 killed 6,434 people and destroyed over 100,000 buildings, laying bare a number of problems in our national earthquake disaster prevention system. Following the lessons learned from this disaster, the Government founded the Headquarters for Earthquake Research Promotion in July 1995 as part of the Special Measures Law on Earthquake Disaster Prevention. Its fundamental objective is to promote research into earthquakes with the aim of strengthening disaster prevention, particularly for the reduction of earthquake damage and casualties.

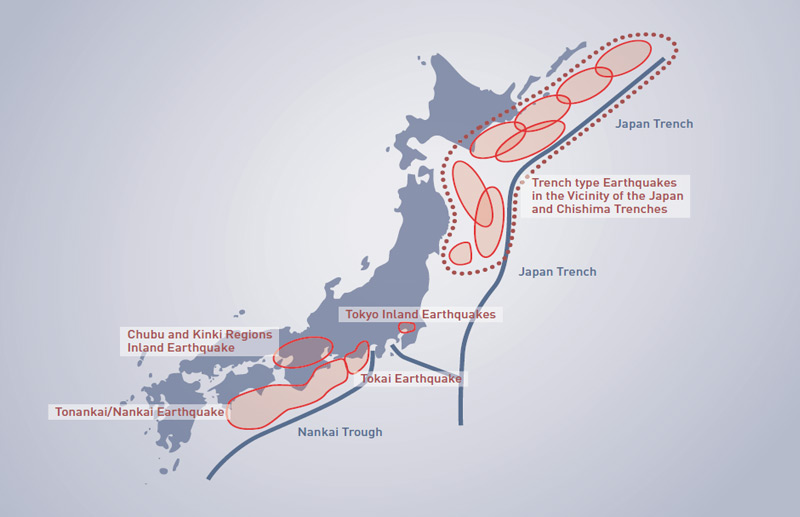

One of its main activities is to publish the Probabilistic Seismic Hazard Map. Unfortunately, the Hazard Map failed to foresee that the oceanic vicinity of the Japan Trench extending from off Eastern Chiba to Sanriku could be struck by a large-scale earthquake such as the Great East Japan Earthquake. Consequently, the Headquarters partly reviewed the then latest edition of the Hazard Map in December 2012. It has also undertaken a revision of its long-term evaluation methodology. The new Hazard Map is still being updated to reflect the reassessment of three predicted large-scale earthquakes -Tokai, Tonankai and Nankaiin Nankai Trough. Its publication has been postponed from the end of 2013 to the first half of 2014.

Source: Modified from Disaster Management in Japan. Cabinet Office, Government of Japan. February 2011 (in English and Japanese). Page 25. http://www.cao.go.jp/en/disaster.html

The General Insurance Rating Organization of Japan (GIROJ) calculates premium rate according to the Earthquake Risk Assessment Model, which is based on the same source model the Headquarters used to create the Probabilistic Seismic Hazard Map. Following a review of the Hazard Map in December 2012, GIROJ filed an application for a revision of the earthquake insurance premium rate with the Financial Service Agency in March 2013. The revised premium, which will become effective on July 1, 2014, will introduce some significant changes, including:

- Basic rates are affected by the review of the source model, resulting in a 15% average increase.

- The number of classes is reduced from four to three to reduce the disparity in premium rate among locations.

- Discounts for Seismic isolated buildings and Earthquake-resistance “Class 3” are increased from 30% to 50% according to earthquake-resistance performance, and reinstated as incentives for making residential buildings earthquake-resistant.

Preparing for the Future Earthquake

Outline of Countermeasures against Large-scale Earthquakes

It has been pointed out with a great sense of urgency that Japan may be struck by largescale earthquakes in the next few decades in areas including Tokai, Tonankai, Nankai, the Japan and Chishima Trenches, and the areas directly below Tokyo, Chubu (Nagoya City) and Kinki (Osaka City) regions.

It has been pointed out with a great sense of urgency that Japan may be struck by large-scale earthquakes in the next few decades in areas including Tokai, Tonankai, Nankai, the Japan and Chishima Trenches, and the areas directly below Tokyo, Chubu (Nagoya City) and Kinki (Osaka City) regions

The Cabinet Office released a damage estimate last May 2013 after examining the possible epicenter zone, the strength of the tremors and the distribution of tsunami wave height. The potential death toll was estimated at approximately 320,000, with a maximum economic loss of 220 trillion yen as a result of three large-scale earthquakes occurring in the Nankai Trough and affecting Tokai, Tonankai and Nankai.

Measures are already being taken in connection with trench-type earthquakes, based on the Disaster Countermeasures Basic Law, including the designation of areas where countermeasure plans need to be strengthened, the reinforcement of observation systems, and the formulation of action plans by the relevant government organizations and private corporations. In addition, preparations such as improvements in evacuation sites and firefighting facilities are being promoted based on laws specifying special financial measures.

It is believed that in the capital area (Tokyo), massive trench-type earthquakes with a magnitude of 8 or greater, such as the Great Kanto Earthquake (1923), will occur at intervals of 200–300 years

With regard to the different large-scale earthquakes, including the Tokyo Inland Earthquake, the Central Disaster Management Council has conducted studies to determine the characteristics of the earthquake estimate its damage and identify the necessary countermeasures. The following plans and strategies for each large-scale earthquake are now being developed: the “Policy Framework”, a master plan that includes a range of activities from preventive measures to post-disaster response and recovery; the “Earthquake Disaster Reduction Strategy”, to set an overarching goal of damage mitigation and strategic targets based on the damage estimation; and the “Guidelines for Emergency Response Activities”, which describes the actions to be taken by related organizations.

Countermeasures against the Tokyo Inland Earthquake

It is believed that in the capital area (Tokyo), massive trench-type earthquakes with a magnitude of 8 or greater, such as the Great Kanto Earthquake (1923), will occur at intervals of 200–300 years. Additionally, it is presumed that several Tokyo Inland Earthquakes of M7 scale will occur before an M8 scale earthquake, and the imminent possibility of such an event in the first half of this century has been pointed out.

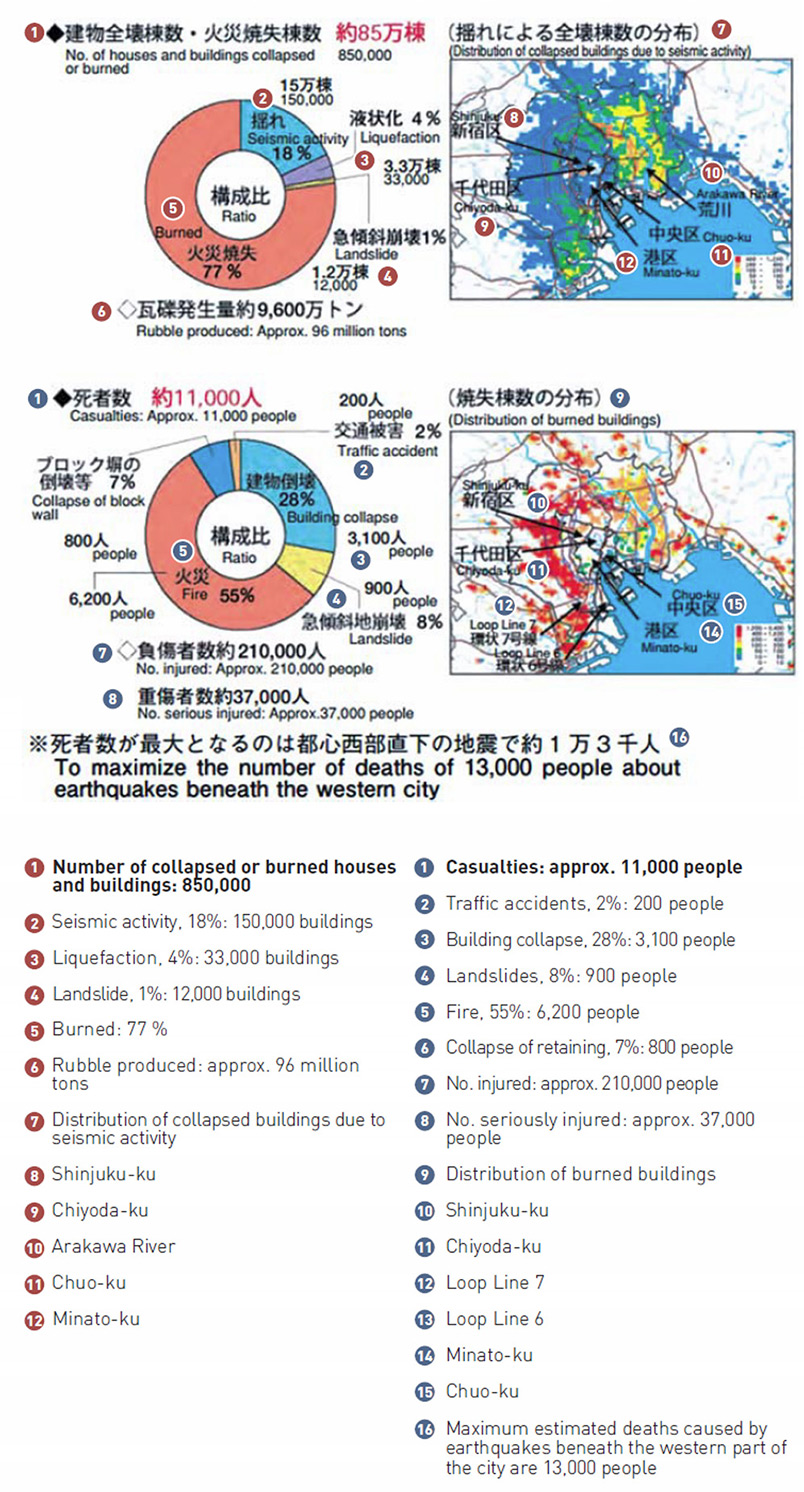

Many types of Tokyo Inland Earthquakes are assumed due to the diversity of possible epicenters and the complex mechanism of the earthquake itself. The Central Disaster Management Council has carried out damage estimations for 18 types of Tokyo Inland Earthquakes, and assumed extensive damage including a death toll of approximately 11,000 people, total collapse of 850,000 buildings and a maximum economic loss of 112 trillion yen in an earthquake with an epicenter in the northern part of Tokyo Bay (assumed scale of M7.3).

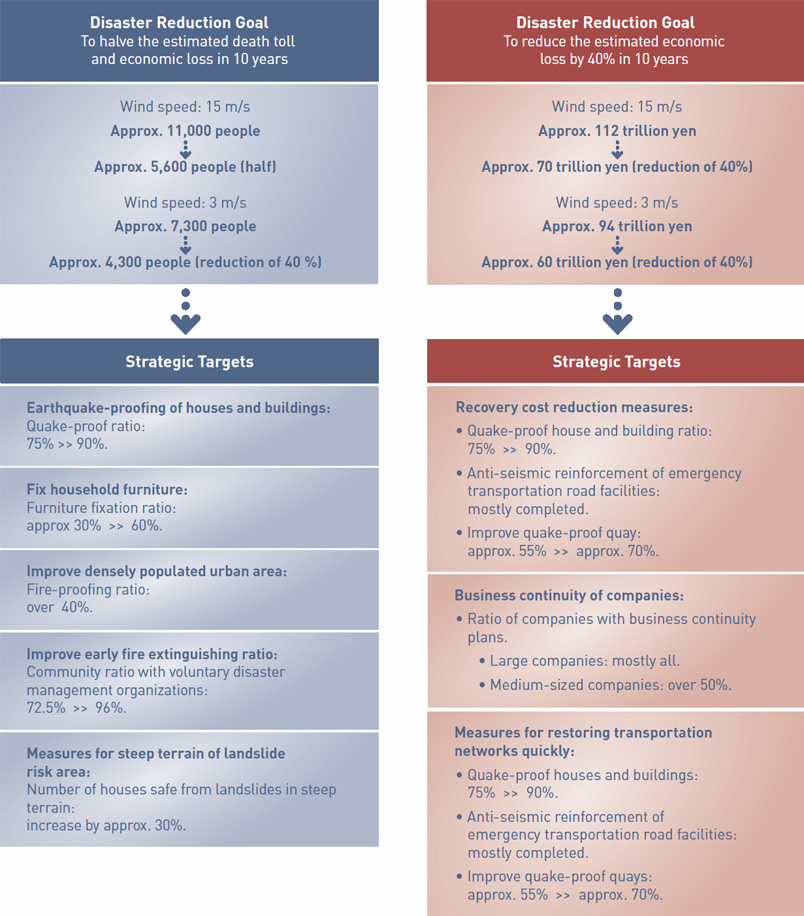

In 2005, the Council established the Policy Framework for Tokyo Continental Earthquakes, with the main priorities being to secure the continuity of the capital’s functions and countermeasures to reduce massive damage. In 2010, this policy framework was revised to include specific measures to handle large numbers of evacuees or travelers unable to return to their homes. Additionally, in 2006, the Council drafted the Tokyo Continental Earthquake Disaster Reduction Strategy, which set the general goals of halving the death toll and reducing the economic loss by 40%, as well as strategic goals including increasing the proportion of earthquake-resistant houses and buildings to 90% of total housing stock and increasing the fixed furniture rate to 60% within 10 years.

That same year, the Council also drafted the Guidelines for Tokyo Inland Earthquake Emergency Response Activities. Plans setting out specific activities were then drawn up on the basis of these guidelines.

Source: Modified from Disaster Management in Japan. Cabinet Office, Government of Japan. February 2011 (in English and Japanese). Page 29. http://www.cao.go.jp/en/disaster.html

Source: Modified from Disaster Management in Japan. Cabinet Office, Government of Japan. February 2011 (in English and Japanese). Page 29. http://www.cao.go.jp/en/disaster.html

About the author: Tadashi Baba

Mr. Tadashi Baba has been Managing Director of Japan Earthquake Reinsurance Co. Ltd. since July 2011.

Prior to his current position, he started his career with Sompo Japan Insurance Inc. (formerly The Yasuda Fire & Marine Insurance Co., Ltd.) in 1977 and has over 30 years’ experience in the Non-Life insurance field, having strong working knowledge of business development, underwriting and strategic planning.

Mr. Baba has also had extensive international experience at Sompo Japan Group for over 15 years, having held prominent positions as Managing Director of Sompo Japan Insurance Company of Europe in London and Managing Director of Sompo Japan Asia Holdings in Singapore.

He graduated from Kobe University in 1977 with a Bachelor of Commerce and completed an MBA with high distinction at Kwansei Gakuin University, Japan, in 1995.

Bibliography

- Introduction to Earthquake Reinsurance in Japan (in English).

http://www.nihonjishin.co.jp/disclosure/2012/en_disclosure.pdf - Disaster Management in Japan. Cabinet Office, Government of Japan. February 2011 (in English and Japanese). http://www.cao.go.jp/en/disaster.html

- Disasters, Leadership and Rebuilding – Tough Lessons

from Japan and the U.S. Wharton. University of Pennsylvania.

October 2013 (in English).

http://d1c25a6gwz7q5e.cloudfront.net/reports/2013-10-01-Disasters-Leadership-Rebuilding.pdf