José María Elguero

Director of the Marsh Spain Research Department

Madrid - SpainMarkets

José María Elguero never thought he would end up in insurance, because his father worked at the General Directorate of Insurance and Pension Funds. But after obtaining a degree in Law, he changed his mind and decided to obtain the certificate of Insurance Agent and Broker. In 1989 he began working at Caser in the Research department. His career skyrocketed from there, leading him to a PhD in Law, an MBA from the Instituto de Empresa in Madrid, and he became a lecturer at Universidad Pontificia de Comillas (ICADE) and other highlevel institutions.

He worked for 14 years in the civil liability department of Münchener Rück. He joined Marsh in 1993 as manager of the financial and professional risk department, and in 2009 he became director of the Research Department of Marsh Spain. He is a regular contributor to newspaper columns and he has written several books. His latest book is Insurance Agents and their Civil Liability: Law 26/2006 on Brokerage of Private Insurance and Reinsurance, published by FUNDACIÓN MAPFRE

“When you overcome a crisis, it makes you stronger”

The view on the crisis in Spain is evolving with changing circumstances and the steps being taken to cope with it. When you are part of an international consultancy and brokerage group, as is Marsh, you have a wider view. Damage and liability are two major insurance business lines. Doctor José María Elguero, Director of the Research Department of Marsh, is one of the leading Spanish experts in the field of liability, especially with regards to Directors and Officers liability, and insurance agents, the subject of his latest book.

As Director of the Marsh Research department, what are your duties?

A basic pillar of this company is business management. In all companies there are departments that drive development and sales and form an integral component of the marketing strategy. The research department is part of this marketing area and our mission is to develop products and identify market opportunities by means of analyses we conduct and reports we draw up. This gains us presence and opinion leadership, factors also important for the customers, because they are more interested than anyone else in knowing the state of the market, how they can protect themselves from risks and how to finance that protection. The Research Department is a Marsh initiative which maintains very significant media presence due to its opinion leadership and because it covers many areas. It is a very cutting edge department.

What is Marsh’s position in the corporate world and regarding the insurance and reinsurance it offers?

In terms of position and what we perceive as our mission, we are active in risk consultancy and then in providing solutions, which entails work in brokerage of insurance, reinsurance and financial solutions, which brings us back to consultancy.

The strategic vision of this company is to be one step ahead of events, so we knew that the crisis was going to severely affect company directors and officers, and that they were going to need protection

Is the crisis unleashed by the payment of overriding commission considered over?

All that ended up getting back on track. When you overcome a crisis, it makes you stronger. Marsh&McLennan has shown that it has a lot of inner strength. We are still number one and the game plan change in the market made us stronger. Maybe our advantage was that as we saw the market rules coming, we met them head on - by simplifying structures, internal process control and transparency. We gained visibility. Sometimes, it is hard even for our own employees to understand this way of doing things, because we do our actual work in the present. But this measure of anticipating the future has made us stronger; it has allowed us to maintain our leading position and to assign a very high degree of importance to good practice.

Our structures are not prepared for a big avalanche of D&O claims. Neither are the economy, companies or the courts

What client profile is Marsh aiming for?

We have three major lines, ranging from the person who wants an insurance policy to the large IBEX 351 companies. Approximately half of the IBEX companies are customers of ours. This gives us a very clear view of the market. You gain a global perspective from working with international companies, but you also keep the local perspective through contact with your small and medium-sized client firms. It is a comprehensive service to meet the needs arising from the risks. We provide solutions both for the launch of a satellite, and for political or commercial risks, as well as meeting the general public’s needs.

In the world of risks, where is the business heading to for brokers in the future? Where does your research department see the potential? What are the big challenges?

In technology, without a shadow of a doubt. We live in the “information society”, with all the risks associated with cyber-crime, cyber-security, technological developments and the communication media. The second challenge pertains to people, their quality of life, bionics, biology, developments and research in the area of stem cells, lengthening life spans, the fight against diseases. A third challenge, which we put on the table at the Davos forum, is everything related to climate change and its consequences. We have been working on this issue for a long time. It has ramifications for communication, transportation, infrastructures, production lines, questions like getting food supplies to Africa, to the Sahel for instance, or whether a nuclear accident like the one in Fukushima could happen again. All this is related to business continuity and supply chains. These are the three priority lines of business. Of course there are many more, but these are the major short-term ones.

The Germans know that crises are intrinsic to the way the economy works, and we will come through this crisis, I am convinced!

And how has the decrease in business associated with the crisis affected you, with the disappearance of thousands of companies and self-employed workers? Not long ago you said that despite all this there was a 30% increase in D&O (Directors & Officers) liability policies.

That is right. A company of our size and scope is compensating for reduced business in certain areas, with a growth in others. It is similar to the way lawfirms achieve balance in their business. The strategic vision of this company is to be one step ahead of events, to predict the scenarios. That is how we knew that the crisis was going to severely affect directors and other senior executives in large companies, who were going to require protection. And there we are; for better or worse, it is now a trendy insurance policy. Last year 7,000 companies that did not have these policies bought them from us, in full recession. In this way, you compensate for what you lose on other fronts. An important factor is risk consultancy, which we never gave up and which helps us to promote the insurance brokerage area. There is a lot of competition in special lines for directors and officers. Part of this comes from the large brokers, the rest is highly fragmented. We have a study that we conducted on management of family-run companies in the Autonomous Community of Cantabria in northern Spain.

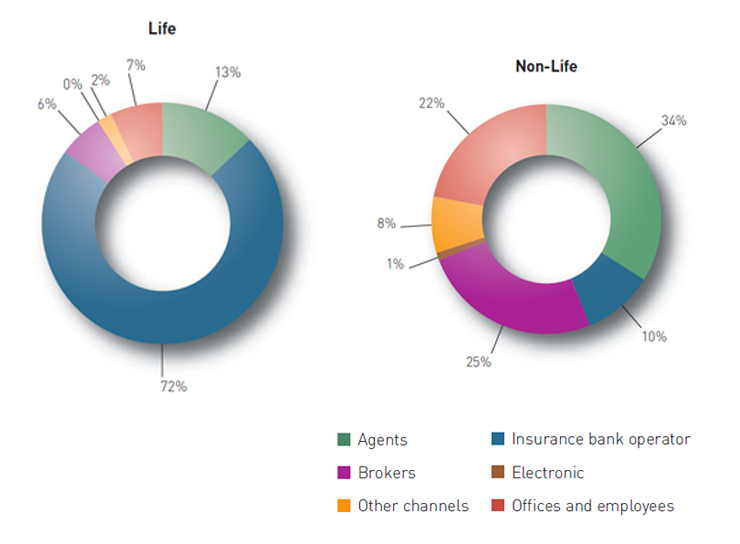

Source: Marsh Research department with ICEA data

Why Cantabria?

Due to several circumstances. First of all, it is a very reachable geographical area, very provincial, with companies we know and who are our clients. We know the institutions, and our business portfolio allows us to have a representative sample that can be extrapolated to other places in Spain.

Continuing with D&O, where did it stem from?

It began to be implemented in Spain in 1989, but its insurance origins date back to Otto Von Bismarck, in Germany, when the German companies began to be subject to liability. Up to then, unethical behaviour by firms had entailed no consequences for them. When the 1929 crash happened, no claims could be made against the directors because the country’s whole economy was collapsing.

Germans are still frightened by the thought of their hyperinflation in the 1920s.

The Germans know that crises are intrinsic to the way the economy works. We will come through this crisis, I am convinced! And we will have another crisis. They come in cycles. You have to immerse yourself in the cycle and try to adapt to it. So that’s it.

Let’s carry on with the historical development of D&O.

Based on the laws on public limited companies, the first policy in Spain was drawn up in 1990. We have here an insurance line that is 22 years old, but which only reached cruising speed in the last eight years. In fact, the study that we conducted shows that it has experienced its fastest growth this year.

When we look at the registries of the General Directorate of Insurance and Pension Funds, we see that 70% of complaints state that claims are not handled properly

Are there many claims?

They have increased by 24%. But compared with other insurance areas, we have not yet seen large peaks. Our structures are not prepared for a big avalanche of claims.

Neither are the economy, the companies or the courts. The truth is that the tendency to claim is increasing. Last year, one in four companies that offered this type of insurance faced a claim. Many are settled out of court.

The agent’s responsibility

Where did you get the idea to write a book like “The Insurance Agents and their Civil Liability”? Why didn’t you include all the insurers and brokers, considering that when we talk about the agent’s liability towards the public, we are also talking about the insurance company’s liability?

Well, there are several reasons for this. First of all, in 2000 FUNDACIÓN MAPFRE gave me a research grant for a paper that I was working on. It was called “the insurance agency contract”, a subject that had not been written about at all. That book was the starting point for what came later. In time, FUNDACIÓN MAPFRE suggested that, as there was a new brokerage law, I could continue to work on and update the whole area of the agency contract. There are several reasons for not including the theme of brokers in my books. First of all, there is already a book by José María Muñoz Paredes, who is a Professor of Commercial Law and a great friend of mine, and who has dealt with the subject extremely well. So, there is hardly anything I could add. Secondly, I work in brokerage, and I would not want that to influence me. But there is another weighty reason that has to do with acquisition of premiums. One in four policies that are sold in Spain is brokered by an insurance agent.

That would be in Non-Life.

True. If we talk about Life, only 13% of policies are brokered, whereas the figure for Non-Life is for 34%. The banks account for 72% in Life. But the average is as stated: one in four insurance policies is acquired by an agent. In the rest of the world, the proportion varies between 2 and 3 out of every 4.

Are there many complaints against insurance agents?

When we look at the records of the General Directorate of Insurance and Pension Funds, we see that 70% of complaints state that claims are not handled properly. This is a very important point to reflect on, and that is what I attempt to do in my book, where you can also find a quite novel view of liabilities, humbly approached in the case of Spain. And there is responsibility, really. For example, if on a Friday someone forgets to notify the company of a new policy that has just been signed and an accident occurs over the weekend, what happens in this case? The agent may be liable. Depending on the agent, the claim will be covered by the company or the agent will have to cover it with his or her policy. If they do not have a policy, they will still be liable.

Are you familiar with the liability situation of the insurance agent in Latin America?

I do not know whether agents in Latin America are more prestigious, but they certainly have a better chance of becoming widely known by oral spreading. The liability situation is probably influenced by the way things are done by their northern neighbour. Most of their legislation, both on insurance and in other areas and regarding penal codes, is directly inspired by ours, by European law. The tenets of the European legal system formed the basis for legislation on the other side of the Atlantic, but with the advantage that the texts and ideas were transferred when their content had already been well tried and tested.

My advice for companies is to examine their risks very closely; all the more so if they are going to go international

What is the situation on brokerage payments?

When the new IMD2 Brokerage Mediation directive is ready, we will have to be even more transparent. Clients will know how much the broker will receive, but this does not worry us. Our customers know this. Some firms have commissioned us to perform audits on policies brokered by other agents, to have a guarantee that they are well covered against their risks.

What is the main concern of the insurance industry in Spain today?

Automobile and household claims. These are increasing at a rate that is not alarming yet, but could well become so.

How important do you consider corporate social responsibility to be?

I am glad you asked that about Marsh, because we have implemented a very nice initiative. On Fridays, the employees are allowed to dress casually but if they do, they have to make a small contribution to a charity fund for social causes, which is run by a volunteer group. Beforehand, the group lets us know by email what the money will be used for.

A piece of advice to companies

They should examine their risks very closely and all the more so if they intend to go international.

The future of the agent

What future does the insurance agent have competing against all kinds of distribution systems and technologies?

I still say that the key element is people.

Provided that they do not make the product more expensive.

Yes, but they are still important. If in addition they can use technology, they will have a great advantage, because the insurance business is quite ethereal; it is based on trust, which is not easy to establish. Insurance agents play a very important role. They must be authorised, guaranteed, trained, have civil liability, and they have the challenge of training, keeping up to date, maintaining their image and reputation, as does the entire insurance sector. Of course, it is essential that they keep up with technology. It would be inconceivable to insist on issuing policies on paper when other documents are sent to you by SMS.

How are insurance agents looked upon internationally?

Of all the countries that I have studied I would highlight the case of Germany and the United States. In Germany, an insurance agent is quite a powerful figure; the business is well regarded and the agents have a good image. In the United States, they are true consultants with a very high degree of professional responsibility to the community. They are officially authorised to do their job. In Spain, as we know, the situation is pitiful. Here, when you want to insult someone you say that they are an insurance agent. In France, Japan, Germany or the United States, insurance agents are well respected. Here, on the other hand, until recently the qualification of insurance broker was given with certain university degrees, even if the graduate had no idea of the insurance business.

Are there not too many insurance agents?

In Spain, there are too many of everything; too many banks [up to now], too many insurance companies, too many brokers, too many insurance agents. This statement is not positive, given the need for solvency, training, and specialisation. Logically, it leads to concentration. When I began working, around 1990, there were over 600 insurance companies in Spain. Today there are 279 left, although many belong to the same group. Without a doubt, there is a long way to go. Agents are destined to group together; this is an important point. A possible solution may be for the formation of agency companies.

Implementation of Solvency II, in 2014 or 2015, although it provides for a long transition period, is going to lead to many small insurance companies joining together, with consequent repercussions for their brokers.

Right, and this is going to happen not only as a result of Solvency II but for other reasons. We know some of these but there will be others that we are not yet aware of. If we have gone from 600 insurance companies to half that in 20 years, how many companies will be left ten years from now?

Would you venture a prediction about how the industry will look in five years??

No. Neither my company nor I personally. Given what is happening in the economy, it is hard to make predictions, not only for the next five years, but even for the coming couple of months. I would like the insurance industry to be solvent, to have a high degree of prestige and a great reputation; but any attempt to outline a strategy for the future would be mere speculation.

In his book “A Brief History of the Future” Jacques Attali predicts a world that will revolve around the industries of insurance and entertainment.

It is very hard to know if we will reach that point. For the time being, the insurance industry, within the financial sector, has done its homework and therefore has been hit less hard by the crisis than other industries. It could be because it has a much better understanding of risk.

References

Marsh España http://spain.marsh.com/

La gestión del riesgo en la empresa familiar de

Cantabria Informe Marsh 2012.

http://spainbeta.marsh.com/Portals/52/Documents/Documents/Estudio Marsh Gestion del Riesgo Empresa Familiar Cantabria Marsh.pdf

El agente de seguros y su responsabilidad civil.

Ley 26/2066 de Mediación de Seguros y Reaseguros

Privados. FUNDACIÓN MAPFRE, 2012.

http://www.fundacionmapfre.org/fundacion/es_es/images/El-agente-de-seguros-y-su-responsabilidad-civil-Ley-26-2066-de-Mediacion-de-Seguros-y-Reaseguros-Privados.pdf

1 The index IBEX 35 (Spanish Exchange index) is the benchmark stock market index of the Spanish Stock Exchange. It comprises the 35 most liquid Spanish stocks traded in the four Spanish Stock Markets (Madrid, Barcelona, Bilbao and Valencia). It is a market valueweighted index. Unlike other indexes as Dow Jones, the weightings of companies are not capped.