Farming and Rural Insurance Funds: the Mexican experience in farming mutualism and its higher organisationsAGRICULTURAL

Raúl Lases Zayas. Managing Director LatinRisk SA de CV

A successful farming insurance experience has been conducted in Mexico, over the last 20 years, through mutuals, mostly consisting of small and medium sized farmers. Its constant upward path, in terms of transaction volumes and excellent technical results, attracted the attention of various international organisations (World Bank, Inter- American Development Bank, CEPAL*) which referred to the case of Insurance Funds as an experiment which must be examined as a potential institutional arrangement viable to be replicated in other countries with medium and low income to provide small - scale farmers with crop and livestock insurance, because its self - management characteristics are ideal for developing an insurance culture.

* CEPAL (Economic Commission for Latin America and the Caribbean)

Background

A direct predecessor of the Insurance Funds was an organisational experiment involving a group of farmers in the North East of the country who, at the end of the 1970s, got together voluntarily to protect the risks inherent in their business.

They did so in response to the inefficiency of the service they were receiving and the opportunity to obtain synergy with other services they were also beginning to handle at that time: credit and technical assistance. The farming insurance they offered to their members was not recognised by the insurance authorities or backed by reinsurance and was therefore not sustainable over time, but for several years they achieved good results and stood as a demonstration that, by means of a process of selfmanagement, farmers had the ability to administer farming risks directly. This experiment sowed the seed that in essence was later picked up by other organised groups which asked the Mexican Government for permission to set up insurance organisations that had shown they could adapt to their characteristics.

Internal organisation and regulation

The formal beginning of Insurance Funds dates from 1988, but at that time their regulation was set up as an exception to current legislation and took the form of an administrative provision of the Mexican insurance authority, the Department of Treasury and Public Credit (SHCP). Over the years, and with the development and size of this experiment, there arose a need for this initial provision to be converted into a document of general bases and afterwards general rules issued by that same authority. It was not until 2005 that, on a proposal of the interested parties and with the support of the legislative authority, the Law on Farming and Rural Insurance Funds was promulgated, which gave them their own legal status and currently regulates their setting up, working and operation.

Insurance Funds have proven to be a good way of introducing Mexican rural producers to a risk management culture based on self-management.

A major distinction with regard to other farming insurance mutuals in other countries is that Insurance Funds tend to be small or medium sized, unlike the large mutuals that can be found in other markets, and secondly, the funds have special legislative regulations which take their own specific characteristics into account and therefore establish different legal rules and regulations from those insurance companies set up as sociedades anónimas (limited companies).

Operation of Insurance Funds

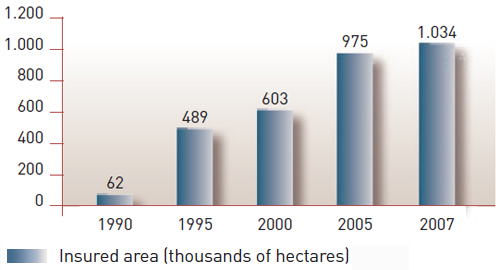

Farming insurance 1990-2007. Insured area

It has been acknowledged that the Law on Farming and Rural Insurance Funds has given the funds a new boost, opening up options to take part in the private sector by developing a private reinsurance market with domestic and overseas companies, which can supplement the public service and ending its monopoly, establishing new types of cover, creating second level organisation of the insurance funds, stipulating development policies and granting them their own legal status, among other important provisions.

The integration, structure and operation of the Insurance Funds comply with the regulations provided in their special law. In general terms, they correspond to the mutuals system, where the highest authority is the General Assembly of Members. They have a board of directors and a supervisory board as well as a director, with a technical and administrative structure suited to the size of their operations.

In their working, like any insurance organisation, they must carry out all the activities inherent in insurance, including scheduling, subscription and claims. As part of this, they are obliged to set up technical reserves and take out reinsurance. In this case, the Law establishes a particular mechanism for reinsurance because the funds are obliged to back all their liabilities which cannot be covered by technical reserves or their other resources with reinsurance. The reinsurance that has been used until now is the Stop Loss or excess of loss over the earnings of their portfolio in a crop season or breeding cycle, even though the Law now permits proportional reinsurance or other combined schemes.

From their financial surpluses, a 25% must be assigned to a cumulative technical reserve intended exclusively for paying claims, 70% to the organisation’s social fund and 5% to other purposes.

A review of special cases of Insurance Funds and the information obtained by means of interviews and consultations enabled us to establish the actual way in which they work and that there is a extensive mosaic of procedures in their formation and operation.

Results

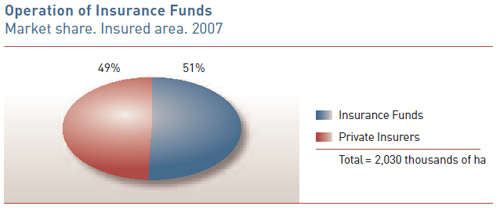

Regarding the analysis of the operational history of Insurance Funds, we found ongoing growth in their cover of farming risks during the period under study which ran from 1990 to 2007, when the funds had already managed to account for a 51% and 28% market share of commercial farming and livestock insurance respectively. The sum total of their insured liabilities in that year amounted to 24,083 million Pesos (in excess of 2,000 million Dollars). The number of funds reporting operations in 2007 amounted to 277, the same number of funds with reinsurance policies.

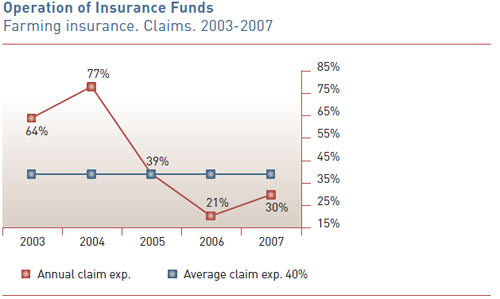

The success of Insurance Funds is also evident in their technical and financial results. Their historical claims experience indices are the lowest in the market. For the period 1990 to 1999, the general annual average was 57% and for the period 2003 to 2007, the claims experience was 40% for farming insurance and 21% for livestock insurance. (There is no official information for the missing years but it is known that it remained at very satisfactory levels).

An analysis of the claims experience of the funds, by size, regional location and any other type of breakdown, does not reveal any significant differentiation in farming insurance and in the case of livestock, the inadequate number of funds in a few segments does not enable us to be assertive but generally speaking the results are fairly acceptable, regardless of the segments taken into account. This is relevant when it comes to demonstrating the viability and adaptability of Insurance Funds as mutual entities, regardless of their heterogeneous structures or orientations.

The success of insurance funds is also evident in the growth of operations and in their technical and financial results.

Insurance Funds in operation in 2007 show, for the programme as a whole, that their risk cover is highly diversified by type of crop and animal species, with a high predominance of cereals and oilseeds in the crops branch while in the livestock branch the most common species are cattle and pigs.

| State | No. of animals 4.106.642 |

|---|---|

| Sonora | 2.367.787 |

| Chihuahua | 469.359 |

| Coahuila | 449.867 |

| Estado de México | 354.311 |

| Nuevo León | 327.063 |

| Nayarit | 52.630 |

| San Luis Potosí | 33.000 |

| Tamaulipas | 20.132 |

| Tabasco | 10.145 |

| Guanajuato | 5.227 |

| Chiapas | 4.366 |

| Campeche | 3.712 |

| Jalisco | 3.677 |

| Puebla | 3.571 |

| Durango | 1.795 |

Another reviewed aspect is the interest shown by three major global reinsurance companies in working directly with the Insurance Funds and offering them financial support. One of these companies has developed reinsurance business directly with the funds since 2006, such that it has built up a significant portfolio with excellent results. Also, domestically, private insurance companies which operate in the agricultural insurance have also tried and succeeded, at least in the case of one of these companies, to link up with the funds via reinsurance. The information also reveals that the reinsurance service provided to the funds by public or private companies has been viable and financially rewarding.

Distribution and size

Insurance Funds cover an extensive geographic area since they are present in 84% of the country’s federal entities or States, although with a high concentration in the North and a still limited presence in the South.

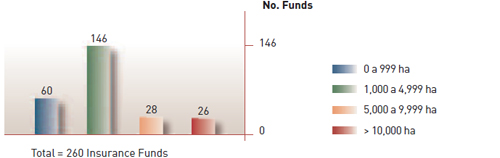

With regard to their size, one of the various ways in which the size of the funds has been measured is according to the number of farms insured. For this purpose, ranges of hectares and insured animals were established and the number of funds per range determined. In the case of farming insurance, results show that the largest number of funds are concentrated in the smaller area ranges. According to 2007 figures, 56% of the Funds could be found within the insured area range running from 1,000 to no more than 5,000 hectares. Secondly, 23% of Funds insured less than 1,000 hectares per annum, 11% of Funds insured between 5,000 to no more than 10,000 hectares and 10% more than 10,000 hectares. In the case of livestock insurance again the largest number of Funds was concentrated in the lower ranges in terms of insurance volume.

Operation of Insurance Funds

Farming insurance. Geographic distribution by federal entity. 2007

| State | No. of Funds 260 | Area (ha) 1.034.342 |

|---|---|---|

| Sinaloa | 66 | 299.814 |

| Tamaulipas | 51 | 195.833 |

| Sonora | 30 | 168.406 |

| Chihuahua | 9 | 94.961 |

| Guanajuato | 22 | 56.813 |

| Morelos | 3 | 37.856 |

| Hidalgo | 8 | 24.645 |

| Baja California | 4 | 23.527 |

| Campeche | 3 | 22.894 |

| Jalisco | 13 | 15.739 |

| Michoacán | 7 | 15.481 |

| Nayarit | 10 | 14.956 |

| Coahuila | 7 | 11.634 |

| Durango | 3 | 10.125 |

| Chiapas | 2 | 7.452 |

| Tlaxcala | 2 | 7.446 |

| Veracruz | 2 | 6.688 |

| Baja California Sur | 2 | 5.880 |

| Puebla | 5 | 5.792 |

| Nuevo León | 3 | 2.999 |

| San Luis Potosí | 2 | 1.625 |

| Colima | 2 | 1.340 |

| Zacatecas | 1 | 1.051 |

| Querétaro | 2 | 935 |

| Oaxaca | 1 | 450 |

Incorporating bodies

The Incorporating Bodies (Organismos Integradores) of the Insurance Funds are legal entities created by the 2005 Law and are designed to be an upper link in the value chain of the farming insurance operated by the funds. These incorporating bodies are associations of Funds which can be set up at local, State or national level.

The functions that the Law assigns to the incorporating bodies are very important (the opinion of the funds’ representatives was taken into account when establishing the content of the Law) and range from advisory activities, training and provision of miscellaneous services to monitoring the operations of the funds and being the channel for informing the authority (SHCP) of this work. This latter function corresponds to a supervisory scheme delegated by the authority, which is based on the participation of the funds themselves through their second level body. The Law sought to reproduce the self-monitoring scheme which existed with proven results in the operation of each fund, given their mutual nature, and take it to a higher level, where self-monitoring is provided through their incorporating bodies which in turn act as a link with the authority.

Studying the incorporating bodies and the knowledge obtained therefrom revealed the major quantitative and qualitative progress achieved in only two years. The national incorporating body was formed in 2006 which now encompasses 13 State incorporating bodies, and the information obtained from the interviews and consultations carried out show us that the incorporating bodies already have technical structures for the professional development of their activities. Also, by 2007 they were already providing various services to their members as well as monitoring operations and submitting the corresponding reports to the authority.

Foreseeable development and new business niches

Taking as a basis the historical development of the Insurance Funds, the sentiment and opinions of their representatives, experience of other models and countries and our own view, we have put together a few proposals regarding subsequent strategic action to guide the future development of the Insurance Fund programme and making the most of new areas of opportunity.

We give below a brief description of such proposals: reinsurance funds, suggesting that they are set up as groups of Funds for consolidating risks, their transfer to a higher authority (reinsurance fund or fund of funds) and their retrocession to the domestic and international market; insurance related to farming, hereditary and rural activities, as part of the new cover for equipment, agroindustries, transport and other cover related to the property risks of the members; rural life insurance, with an opportunity for the Funds to provide a social service to their communities at the same time as developing their own infrastructure and making their costs more efficient; national system of fund information, essential for consolidating the above mentioned risks, negotiating reinsurance and the technical design of new cover, among other things; farming income insurance, which offers cover which includes protection against both natural and market risks; catastrophe insurance, with the Funds taking part in programmes already established by the Federal Government with the involvement of the federal entities; Fund promotion and cover design in the Southern region of the country, which would deal with the region with the smallest commercial farming insurance cover in the country. In the medium term, the implementation of these strategic actions would make up the Insurance Funds’ contribution to the future development of farming insurance in Mexico.

Assessment for a Funds scheme in other countries

On the basis of the background information and characteristics of Mexican Insurance Funds and reviewing similarities in experiments organised by the farmers of other Latin American countries, we have come to a positive conclusion as regards the huge potential there is in replicating the Mexican experience throughout Latin America. In order to boost farming mutualism in those countries, both the Government and insurance companies, and of course the farmers’ organisations, have to work in coordination on the policies, regulations and design of risk management schemes suited to their particular circumstances, for which we have also proposed a few lines of action.

Coordinated work by the government, insurance companies and producer organisations in each individual country is needed in order to advance farming mutualism in Latin America.

Final message

Let the study and disclosure of the Insurance Funds experiment serve as an incentive to Mexican farmers to make further advances in cooperative and mutual action, within the framework of an open, competitive market economy, with areas of collaboration with every type of company and sector; let it also serve to allow the farmers, insurance companies and government of other Latin American countries to have a new reference point on inclusive and innovative alternatives for the boost that farming and rural insurance requires in our countries.

In 2008, the FUNDACIÓN MAPFRE sponsored a specific study, the purpose of which was to go deeper into this subject. In this article, we have given a brief summary containing relevant aspects of that work.