Global reinsurance marketMarkets

Martyn Street

Senior Director – Insurance

Fitch Ratings

2015 will be a tough year for reinsurers

The absence of large losses, intense market competition and sluggish demand from reinsurance buyers has resulted in a softening market for reinsurers, characterised by falling prices and, less visibly, weakening terms and conditions. The high level of surplus capital held by reinsurers within the sector increases the likelihood of soft market conditions continuing into 2015, although the rate and extent of further price deterioration is unclear.

Ironically, the favourable underwriting results posted by the industry since the record catastrophe loss year in 2011 has fostered the current challenging reinsurance environment. Reinsurers’ profitable results are attracting more capital to the sector, some from alternative non-traditional sources, which has created excess reinsurance underwriting capacity, leading to price competition and falling reinsurance rates. However, recent performance reveals that pricing and competition need to deteriorate significantly more before profit erosion becomes untenable, as reinsurers in aggregate posted combined ratios below 90% and returns on equity (ROE) of around 12% in the last few years.

Soft market or structural change?

Reinsurers’ profitable results are attracting more capital to the sector, some from alternative nontraditional sources, which has created excess reinsurance underwriting capacity, leading to price competition and falling reinsurance rates

When making longer-term analytical assessments, it is important to distinguish between short-term cyclical fluctuations and longer-term structural trends. Price reductions that are the result of lower loss experience or temporary, opportunistic swings in capacity are reflective of the underwriting cycle that companies would manage through as part of the normal course of business.

In contrast, the growth of alternative capital and changes in reinsurance purchasing habits are expected to have long-term implications for the sector. The emergence of alternative capital within the reinsurance sector is an enduring credit negative to traditional reinsurers’ ratings. It remains unclear whether changes in primary companies’ reinsurance purchasing habits are permanent or cyclical.

US property catastrophe prices hit by perfect storm

The US property catastrophe reinsurance market has been the focus for market commentators for some time, most recently due to double-digit percentage point price cuts across some lines. The current pricing deterioration that has occurred is viewed as a combination of a cyclical soft market and structural change, created by the perfect storm of low loss activity and intense supply-side competition. The cyclical soft market was preceded by a build-up of underwriting capacity in recent years, primarily due to a reduction in windstorm activity and associated insured losses across the peakzones of the Gulf of Mexico and southern US states.

Source: Fitch.

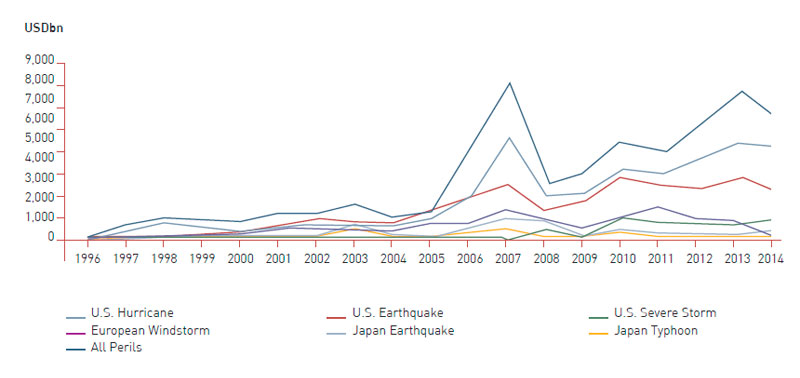

Structurally, the availability of underwriting capacity has been exacerbated by the continued ingress of alternative capital, which has grown especially rapidly in this part of the reinsurance market. This has intensified competition, both between new alternative entrants and established traditional players, and more recently amongst traditional reinsurers as they look to preserve market share. Figure 1 highlights the marked growth in catastrophe bond issuance since 2008.

While the growth of alternative capital is likely to lead to a natural evolution of the market rather than sweeping reform, it does represent a structural change for traditional reinsurers, prompting some market observers to question the long-term viability of traditional reinsurers that have a high exposure to these conditions.

Changes affecting the wider market - casualty next?

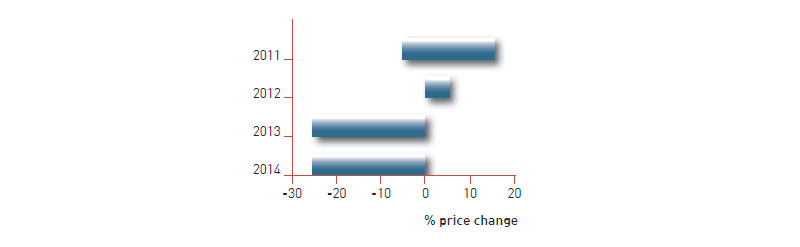

To a lesser extent, a reduced claims burden and intense competition has seen softening market conditions extend more broadly throughout the reinsurance sector during 2014. Some of the main pricing falls observed at the April 2014 renewals, which is an important renewal date for Asia-Pacific business, saw marked declines for Japanese business, with prices for loss free earthquake and wind/flood programmes decreasing by up to 20pp. The negative movement follows more than two years of significant rate increases after the 2011 losses that affected this region. With losses «earned back» by reinsurers, there is naturally going to be some price readjustment.

Looking to 2015, one of the key market sectors to watch is casualty lines. As property catastrophe continues to soften, traditional capital is likely to be redirected to lines seen as providing greater pricing adequacy, such as casualty. In addition, 2014 saw the emergence of alternate capital in the casualty business with the formation of a specific sidecar company.

It is too soon to judge if a specific vehicle like this, which will employ an alternate investment strategy (heavily hedge fundmanaged non-investment grade secured loans) designed to give it a pricing advantage, will gain any real traction. However, some traditional reinsurers may decide to be proactive in defending their market share from a potential new wave of hedge-fund backed casualty reinsurers by cutting back on pricing. This would provide yet another source of pricing pressure in the near term. If vehicles like the one mentioned gained real traction, such pricing pressures would endure.

US Property Catastrophe - Loss Free.

Source: Company and broker reports.

Source: Willis Re.

Falling prices and price adequacy

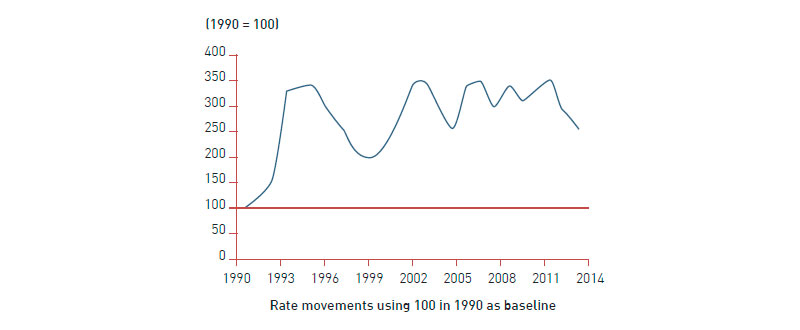

While the observation of pricing movements is important, it is also necessary to consider pricing adequacy. Figure 2 highlights the rate change for loss free US property catastrophe business renewed at the June-July renewals. A reduction in insured loss activity saw prices change from increases up to 15% in 2011 to decreases of up to 25% in 2014. As a result, rates are at their lowest level since 2005, prior to Hurricanes Katrina, Rita and Wilma (KRW) hitting the US that year (see Figure 3).

As property catastrophe continues to soften, traditional capital is likely to be redirected to lines seen as providing greater pricing adequacy, such as casualty

Many reinsurers publish data on how they view the adequacy of pricing across major classes. Indicators usually assess adequacy on an economic basis, looking to achieve a rate of return above a benchmark level that is often the company’s cost of capital. For example, recent commentary from reinsurers following the mid-year 2014 renewals have indicated that market pricing for property catastrophe risk has dropped into the high-single digit expected returns, a level which many market players consider inadequate given the risk and volatility of catastrophes.

Market pricing for property catastrophe risk has dropped in 2014 into a level which many market players consider inadequate given the risk and volatility of catastrophes

The differing hurdle rates and variations in how individual reinsurers classify business classes dilutes comparison with peers, although a review of the data that has been published during 2014 by certain European reinsurers indicates that they continue to view US property catastrophe, at the highest class level, as being profitable. This view is independently supported by long-term pricing indexes that suggest that on a historical basis, prices remain high despite the sharp falls reported in the last two years.

Three major risks to be faced by reinsurers during 2015

- Deterioration of pricing adequacy and

terms and conditions

In the absence of a major loss event, pricing and terms and conditions for the majority of business lines are expected to deteriorate during 2015, increasing earnings pressure across the sector. However, the price adequacy of written business, which usually considers a rate of return above a company’s cost of capital, is expected to remain positive for most classes. The ultimate outcome of renewals will be partly influenced by the volume of underwriting capacity that is redeployed by reinsurers as they reduce exposure to certain North American classes.

Many loss-free casualty reinsurance rates have softened through 2014 and this could extend into 2015. This pressure is being driven in part by increased competiveness in the casualty market as more reinsurers look to non-catastrophe lines for profit. The profit margins of casualty classes are viewed as increasingly attractive by many reinsurers, in contrast to property lines. The fundamental difference between property and casualty risks, including longer-tail liabilities for the latter, are viewed as a hurdle for reinsurers that would otherwise be new entrants into the casualty market. The growth of alternative capital within the casualty sector is also expected to be slower than the property market, reflecting reduced investor appetite for longer duration risks that are less easily modelled.

- Search for higher yields increases risk

as low returns persist

The persistence of low investment yields increases the risk of the reinsurance sector being exposed to adverse investor behaviour, driven by a search for higher yields. Increasing the risk weighting of assets held within an investment portfolio, in a search of higher yield, is an option available to all (re) insurers. Unique to the reinsurance sector are the adverse consequences of capital flowing in as external investors, including pension and hedge funds, search for yield by investing in alternative reinsurance products such as catastrophe bonds.

Unique to the reinsurance sector are the adverse consequences of capital flowing in as external investors, including pension and hedge funds, search for yield by investing in alternative reinsurance products such as catastrophe bonds

The ingress of alternative capital poses a greater long-term threat to the reinsurance sector because of the potentially permanent erosion of profit margins on historically profitable products. There is a growing acceptance within the industry that a significant proportion of these funds will have a permanent presence within the reinsurance sector, due to the portfolio diversification that catastrophe risk provides for investors.

Low interest rates will exert earnings pressure for all reinsurers during 2015. While long-term interest rates for several developed countries, including the US and UK, are forecast to rise next year, their absolute level is forecast to remain below the historical long-term average. Subsequently, reinvestment rates for reinsurers with longer duration fixed income portfolios are likely to be lower than for maturing instruments.

The possibility of protracted low investment yields is unlikely to result in reinsurers deviating from their core investment strategies. These include maintaining sufficient liquidity to meet and settle liabilities in a timely manner, and avoidance of excessive balance sheet volatility. The investment risk profile of a majority of reinsurance companies remains conservative, with fixed-income bonds representing the main asset class. Within this category, there has been a gradual shift away from government to corporate instruments, partly driven by a more stable and improving economy but also in search of higher returns.

While currently limited in scope, the (re) emergence of hedge-fund sponsored reinsurers employing an alternative investment strategy is another sign of some capital providers addressing the limited yield on traditional investments. The use of targeted excess investment returns to provide a pricing advantage can also be a source of soft market pressure if such vehicles gain traction.

- Structural change threatens to weaken

competitive position

It remains unclear exactly how the growth of alternative capital and changes in reinsurance purchasing habits will affect the sector, although the impact is likely to be both negative and enduring. These two trends represent a major challenge for traditional reinsurers, as each is expected to reduce demand for traditional reinsurance products. Of the two, the growth in alternative capital is expected to exert the greatest influence on the future competitive position of traditional reinsurers.

The emergence of the alternative reinsurance market is on balance a negative for reinsurers’ credit ratings and financial strength in the current competitive market. While there are some positives for individual companies (ie, added fee income), the added competition and increased supply of capacity from the capital markets has served to meaningfully dampen reinsurance pricing and resulted in a deteriorating profitability profile for the reinsurance sector.

The erosion of traditional reinsurers’ profit margins reduces their ability to absorb underwriting volatility, should it occur. Reinsurers that are especially vulnerable to the current market conditions are those with a greater exposure to property catastrophe risks, as third-party capital continues to focus on model-driven property risks, and, in particular, US peak zone risk, which historically has the highest margins.

Changes in reinsurance buying habits will likely reduce the overall amount of reinsurance protection purchased, particularly by larger primary cedents. Primary insurers are retaining more risk with favourable capital levels to boost returns in the face of low investment yields. It is unclear to what extent this will prove to be a structural or cyclical change.

Changes in reinsurance buying habits will likely reduce the overall amount of reinsurance protection purchased, particularly by larger primary cedents

Historically, primary companies have increased reinsurance purchasing as prices fall. But large cedents increasingly transact business in a centralised way and on a global scale. Using increased data and more readily available sophisticated modelling, these companies bundle risks into multiple territory programmes, with peak risks then being placed on an excess of loss basis. Subsequently, programmes are better diversified, which, together with an increased scale, allow the cedent to retain a greater proportion of their risk than smaller cedents can.

Decreased demand for reinsurance is also driven by recent benign underlying loss-costs trends that have allowed insurers to be more comfortable accepting risk and volatility. These trends could easily reverse, as an unexpected shift in inflation or interest rates would specifically influence insurance claims’ costs, such as medical costs, litigation settlements or social inflation. Under such a more cyclical change, demand for risk protection by primary insurers could increase and shift business back to reinsurers.

Picking winners is not straightforward

Identifying winners and losers is not straightforward as the effects of falling premium prices and weakening terms and conditions can take years rather than months to depress an individual company’s financial strength and be reflected in reported financial results. This point is emphasised by current results that present a solid financial picture, underscored by strong capitalisation and near record profitability. Small mono-line property catastrophe reinsurers, without other distinguishing attributes, are viewed as the most vulnerable to a protracted period of market price softening. This is because of a more limited ability to set and control contract terms and achieve controlled diversification into less exposed lines.

It is possible to identify two separate and distinct reinsurance groups: monoline reinsurers whose strategy is to write business that is technical but analysable, usually through the use of models, and traditional portfolio reinsurers that write a more diversified book of business with a longer-term profitability horizon

Predictive surveillance can be enhanced with the use of a qualitative assessment that seeks to determine an individual company’s vulnerability to continued price softening and the structural changes being observed. A good understanding of a company’s position within the wider market, as well as an assessment of its strategy, can provide a useful insight into how the fortunes of one may pan out versus a competitor.

Typical qualitative early warning indicators include: significant diversification or shifts into new business or geographic markets, where the company may lack strong knowledge; and above market growth, which may increase a reinsurer’s exposure to under-priced business or indicate a lack of underwriting discipline. Another signal is that of a reinsurer writing business that falls significantly below the reinsurer’s technical price floor, to maintain market share, but this last factor is very difficult to detect.

Reinsurer strategy: mono-line and portfolio reinsurers

The universe of global reinsurers is diverse, with companies varying in size, geographic scale, product diversity and risk appetite. Corporate strategy is key in determining each of these variables. From the biggest picture perspective, it is possible to identify two separate and distinct groups.

The first is mono-line reinsurers whose strategy is to write business that is technical but analysable, usually through the use of models. The profitability of each individual transaction is a key determinant to writing the business, meaning that hard market conditions favour this group. US catastrophe programmes represent one such area where companies of this type would focus and operate. During soft market conditions, sustaining profits can be challenging, with a company’s viability requiring a disciplined approach to cycle management, and an ability to vary the amount of capital within the company in tune with the cycle.

Identifying winners and losers is not straightforward as the effects of falling premium prices and weakening terms and conditions can take years rather than months to depress an individual company’s financial strength and be reflected in reported financial results

The second group comprises traditional portfolio reinsurers that write a more diversified book of business with a longer-term profitability horizon. Profitability is assessed across a portfolio, where a lower return for one transaction may be offset by higher profitability from another. Companies typically have the scale and scope to write globally placed premium, seeking to optimise capital allocation through diversity. In contrast with the first group, these reinsurers seek to prioritise portfolio management and can move in and out of lines of business. They also can accept some degree of under-pricing in certain lines if offset by profits in others, as long as not taken to an extreme. Nonetheless, these companies can still face an erosion of earnings, if the soft cycle is prolonged and broadens into numerous lines.

Scale and diversity suggest greater financial resilience

The concept of tiering, which places individual reinsurers in a specific tier based on one or several metrics, has been used by some market commentators to support views on how the sector may evolve. Usually, those companies that appear in the top tier are the largest and arguably most diversified players, who are viewed as being the best placed to withstand and potentially profit from current market forces.

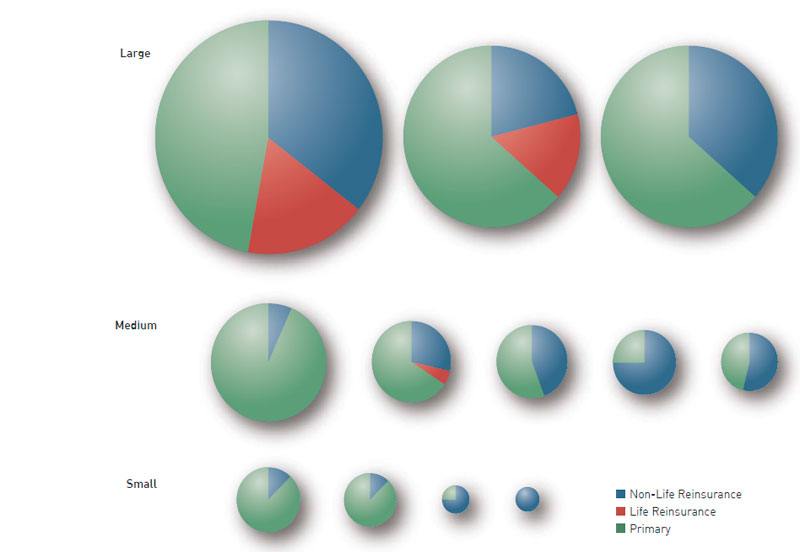

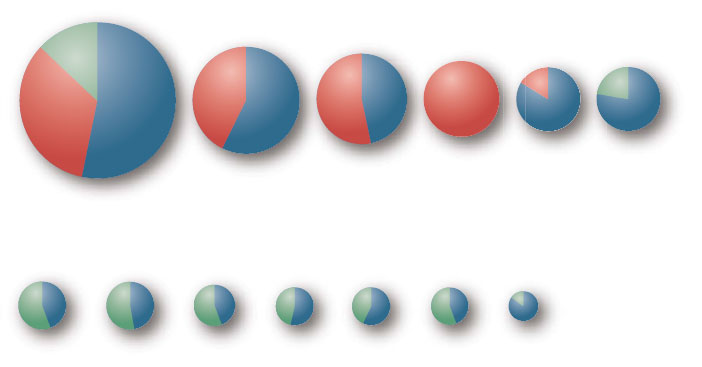

Figure 4 provides an illustrative example of the tiering concept, in this case with reinsurers being placed into their respective Market Position and Size/Scale category, as assigned by Fitch. They are size-ranked based on total net written premiums (including primary premiums where applicable), given the current focus on declining premium prices. Comparing geographic and portfolio diversity is made more challenging given the lack of comparability between individual companies reporting.

Source: Fitch.

Value provision and realisation are less size-dependent

Scale and diversity are viewed as two factors that can allow a reinsurer to be resilient when market conditions grow more adverse. But the provision and realisation of value within the reinsurance purchasing chain is also considered as an important key determinant of an individual reinsurer’s continued success. Value can be derived from factors including specialist product knowledge and technical expertise, offerings that are less size-dependent but often are sought-after commodities for some reinsurance buyers, whether their requirements are for traditional or alternative reinsurance products.

Fitch’s 2015 rating outlook

Fitch maintains a stable outlook for the ratings of the reinsurance sector. We believe most reinsurers will maintain both profitability and balance sheet strength over the next 12-18 months commensurate with current ratings. There is an increasing risk, however, that a select group of smaller reinsurers, especially those with more heavily exposed property books, could experience downgrades and/or movements to Negative Outlooks. In aggregate, such negative actions could be offset by upgrades of a select group of larger, more diverse players seen as most resilient to market conditions.

Note: Bubble size denotes total NWP (Net Written Premium) including Non-Life reinsurance, Life reinsurance and Primary business, where applicable. Primary includes all business not designated as reinsurance segment.