Interview with Montserrat Arnau

Deputy Head of Technical and Pensions

Endesa

Madrid - SpainPersonal

Madrid-born Montserrat Arnau studied Business and Economics Complutense University and in 1992, she graduated with a specialty in actuarial sciences. Her entire career has been in insurance. She started out her professional life in 1992 when she joined the technical department of personal insurance at Centro Asegurador in an actuarial capacity. In the year 2000 she became head of the department, gaining membership of the insurer’s management committee. Two years later, she signed up with Enel Group as a deputy general manager, a position she held for three years.

In late 2005 she started working as an external social security advisor for Endesa and it was in 2007 that she was appointed deputy technical and pensions head at the company. She went on to become secretary of the Endesa Group pension scheme in 2012. In the international sphere, she is currently global head of Endesa’s Insurance & Health programme.

In parallel to her main occupation, she also works with the insurance broker G. Baylín Correduría de Seguros on numerous pension commitment externalisation programmes, which involves assessing and negotiating offers with the leading insurance companies operating in the field of social benefits provision.

She has thus played a key role in the externalisation programmes implemented at Endesa, Nissan and Aceralia, to name but a few of her largest and most salient projects in this area. All these endeavours required her to work closely with the management of the respective groups to establish terms of insurance, value existing commitments, select insurers and negotiate the policies issued.

«Insurers and pension scheme managers will have to face the challenge of developing products that are attractive to their customers and deliver added value compared with other savings instruments»

The actuarial profession is more eventful than ever. Longer life expectancy may lead to severe imbalances in the Spanish state pension system in the long term. This state of affairs calls for maximum stimulation of creativity, innovation and competitiveness in the profession to develop products with the power to captivate consumers. Stressing the crucial importance of corporate benefit schemes, the actuarial expert Montserrat Arnau discusses these and other matters in this interview, including the future, savings, taxation and retirement.

How would you describe the current state of supplementary social benefits in Spain?

The development of supplementary schemes in Spain has been significantly constrained by highly protective state benefits. Nonetheless, the ongoing reforms of the state pension system will most likely change the way the public view this issue, and this will help both corporate and individual supplementary schemes to get off the ground in the medium term.

Supplementary benefit schemes enable companies to take on pension commitments towards their employees in similar conditions to a pension plan or Life insurance

Is this a growing segment? What are the boons of supplementary social security?

Again, it appears certain that Spanish families will eventually need more instruments to channel their long-term savings efficiently. Insurers and pension scheme managers will have to face the challenge of developing products that are attractive to their customers and deliver added value compared with non specific savings and accumulation products.

Another key aspect is whether we will see tax incentives introduced in the next few years to encourage long-term saving, and to what extent those incentives will specifically apply to supplementary benefit schemes.

Focusing on company benefit schemes, what advantages do they bring employees apart from favourable tax treatment in some cases?

Many of these products enable employees to defer reception of a portion of their salary, often with the option to receive their benefits as a regular income when they become entitled to it. They adapt to the recipient’s needs at the time of reception. So whether or not they provide tax relief, company benefit schemes enable employees to plan the time at which they receive a part of their income in the way that is most financially and fiscally advantageous to them.

Moreover, from a strictly financial perspective, businesses are in a position to secure significantly better financial and technical conditions than individual employees, simply as a result of scale economies.

Endesa, leader of the Spanish electricity industry

Endesa came into being on 18 November 1944 when construction of the Compostilla power station began in Ponferrada, in the northwestern Spanish province of Leon. Seventy years on, Endesa is the leading player in the Spanish power industry and the largest private electricity multinational in Latin America. Its almost 23,000 employees provide service to more than 25 million customers.

The Enel group, which owns a 92.06% of Endesa, is the largest electricity company in Italy. Enel also owns most of Italy’s electricity distribution network and it is an active operator in the production, distribution and sale of electric power and gas.

The Spanish Insurers’ Association (UNESPA) claims that retirement savings do not enjoy a particularly favourable tax treatment, and is calling on the government to encourage supplementary benefit schemes as part of its tax reform. What is your take on this matter?

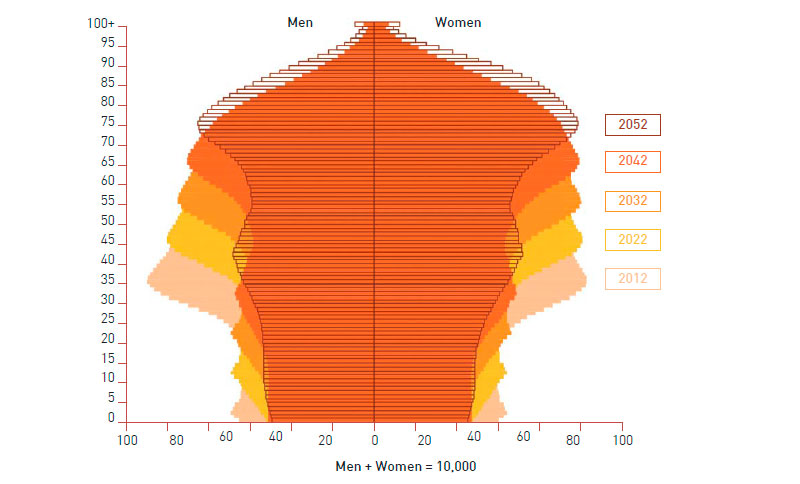

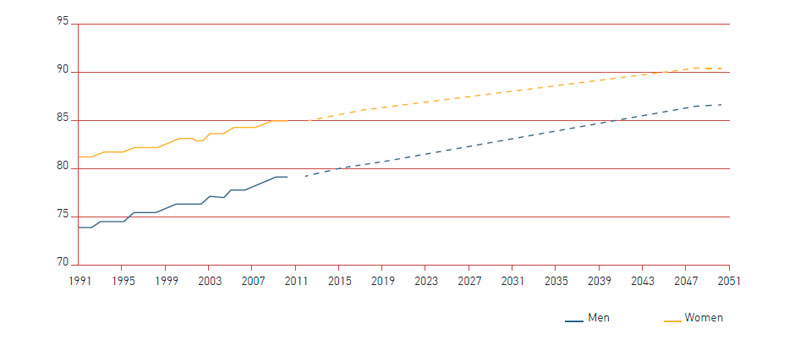

The most predictable consequence of Spain’s demographics and growing life expectancy is overall ageing of the population. In the long term, this may lead to major imbalances in the state pension system. Encouraging long-term saving should be a priority for all governments, now and in years to come. Tax incentives are an efficient way to solve this problem, but they are not the only way.

Encouraging long-term saving should be a priority for all governments, now and in years to come. Tax incentives are an efficient way to solve this problem, but they are not the only way

This year seems to have bucked the trend of previous years, where retirement was not a main concern for Spanish people according to the CIS1. Polls carried out in 2014 show that 50% of the population are concerned about their future. What do you think has caused this shift?

There is probably no single explanation, but it is reasonable to believe that the pension system reform of the last few years may have played a large role in this change. In addition to that, the economic crisis compounds feelings of uncertainty within society and consequently, concerns about the future.

1 CIS: Centro de Investigaciones Sociológicas.

Starting in October 2004, the Spanish Social Security will be sending a pension estimate at age 65 to all working people over 50 years old. Private companies will also eventually be required to provide this information to their employees. What is your view on this initiative? Will it help to drive benefit schemes?

As I said earlier, tax incentives are not the only way to encourage long-term saving. Showing individual employees on a regular basis how their income will actually be reduced when they retire is also a powerful way to heighten awareness in society. This will increase the need to build sufficient savings to supplement state benefits receivable in the future.

What is your view on the Spanish saving culture?

Showing employees on a regular basis how their income will be reduced when they retire is a powerful way to heighten awareness in society

The development of saving in Spain has been heavily influenced by two circumstances: a state pension system that provides a high degree of cover, and families’ traditional use of their main residence as their principal instrument for asset accumulation.

It may be that Mediterranean societies are less given to save and this has contributed to the smaller weight of long-term savings in the GDPs of those countries. But where Spain is concerned, I think it would be difficult to establish whether that explains or is actually a consequence of the two facts I mentioned.

What is supplementary social benefit provision?

The latest initiatives launched by the Spanish government to reform the state pension system have reopened the debate on the sustainability of state pensions and whether retirement savings in the Spanish private sector (i.e. families and businesses) have sufficient bulk to compensate a potential future shortfall in state benefits.

Supplementary benefit provision is channelled through a number of specific instruments (essentially, pension schemes and Life insurance) which supplement state-provided retirement, surviving spouse, orphan, disability and dependant benefits.

These schemes are available to individuals and companies, which enrol their employees either as part of a collective bargaining process or as a welfare perk which businesses voluntarily provide as a way to increase staff motivation and retention.

Supplementary schemes still display a limited degree of development in Spanish companies compared with other western countries, but some of the largest firms have traditionally operated strong social protection systems to supplement their employees’ state benefits. Thus, Endesa has a dedicated social benefits department within its directorategeneral for human resources.

What role are employee benefit schemes currently playing in businesses, including Endesa in particular?

In my opinion, at a time of severe economic challenges where all reports point to a bleak future for state pensions and families losing saving capacity, company benefit schemes have become extremely valuable to employees in firms with a strong history of providing them.

However, companies where supplementary benefit schemes are weak or non existent are finding it harder to implement new systems or to improve the ones in place, because they have had to prioritise maintaining their employees’ immediate purchasing power or even their level of employment over other incentives.

What do Endesa employees across the world think about these solutions, which are offered by Human Resources? Indeed, have any studies been performed to gauge their degree of satisfaction?

Endesa is in fact the result of takeovers, acquisitions and mergers with companies operating a range of widely differing benefit schemes. In all these processes, Endesa has consistently followed a policy of preserving employees’ vested benefit rights under the same terms as in their companies of origin.

In Spain, which is the most complex example in this regard, respecting those rights meant accommodating more than a hundred separate groups, each with its own benefits and cover, among a host of other differences.

For a good number of years, all we were able to do was examine, organise, implement and optimise all those rights. Only once that was completed did it become possible to undertake other initiatives, such as developing what we call a social benefit register. The first social benefit register was circulated to all our employees in 2010. It provides a personalised, quantitative overview of each beneficiary’s rights with explanatory notes on aspects including the types of instruments where they are incorporated.

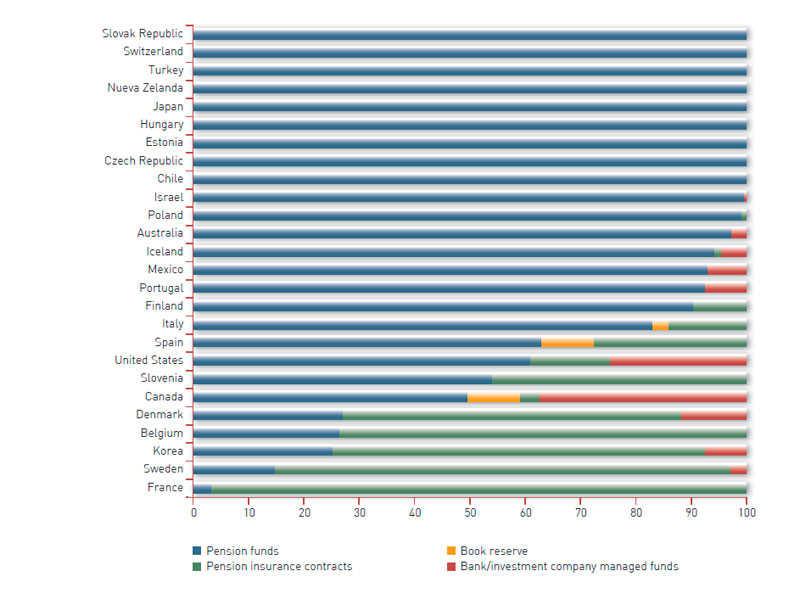

As a percentage of total assets.

Source: OECD, Global Pension Statistics (http://www.oecd.org/pensions/public-pensions/OECDPensionsAtAGlance2013.pdf).

We have also had a number of meetings with the different groups to provide detailed explanations on their benefits rights, how they are implemented, when they are entitled to claim them and other important aspects.

All these initiatives have been very well received and appreciated by our employees. Nonetheless, there is still important communication work to be done to highlight the value of the benefit schemes we are fortunate enough to have in companies like Endesa.

Insurers and pension scheme managers will have to face the challenge of developing products that are attractive to their customers and deliver added value compared with non specific savings and accumulation products

What aspects do you think Endesa takes into consideration when purchasing these products from an insurance company?

The key priorities are, in this order: solvency, confidence and service.

In what ways does pension reform affect supplementary benefit provision? How is Endesa adapting its future plans to coming changes in state pensions? How might those changes affect the private savings sector?

Pension reform can only have one effect, which is to strengthen the role of supplementary social security, including company benefit schemes and schemes based on family savings. Initiatives need to be taken to heighten awareness of the importance of supplementary schemes among the working population - particularly among young people, who view death, disability, dependency, retirement and the needs these events entail as something quite far off.

Source: INE (http://www.ine.es/prensa/np744.pdf)

As I mentioned before, I believe people are generally unaware of what supplementary benefit schemes involve, what purpose they serve, what types of schemes are available and how to become a member. At Endesa we intend to keep working to change this so that employees are able to plan their own needs. This involves ensuring they are fully acquainted with the benefits they will receive in the event of any contingency and what personal savings will provide.

It has recently been published that it will become possible to surrender pension funds after ten years. Does this also apply to employees in companies like your own?

The development of saving in Spain has been heavily influenced by two circumstances: a state pension system that provides a high degree of cover, and families’ traditional use of their main residence as their principal instrument for asset accumulation

This is a new regulation about which we already have some information, but which will probably be further debated before it is finally approved. Still, I think not enough time has passed to be able to tell how the different industries will react to this initiative.

Be that as it may, Endesa has always asserted the belief -both for business and for social reasons- that company benefit schemes must fulfil the purpose for which they were created, i.e. to protect employees in the events of death and disability, as well as after retirement. Accordingly, we are not inclined to introduce instruments enabling early release outside of those contingencies.

Is employee mobility giving rise to new benefit schemes? Do expatriates take their vested rights and commitments with them or are they compensated in a different way?

Endesa expatriates take their vested benefits and commitments with them when they travel, with the following special rules:

- All employees have the same health care cover regardless of their original rights, via a refund policy with global cover.

- Death and disability covers are subject to certain minimum risk benefits for all expatriates, regardless of the cover they are entitled to according to their original rights.

Source: INE

Within Endesa, which are the most attractive company scheme models internationally? Which are the leading countries and why?

I think the supplementary benefit schemes available in each individual country are closely tied up with their culture and tradition in the area of social security and also with local market practices.

That being so, Spain has the most developed company benefit system because our origin lies in a large state-owned company, the INI2, which created the companies that have traditionally enjoyed the strongest benefit schemes.

Some countries require employers to enter their employees into a pension scheme and then allow them to decide whether they want to pay into it or not. Would that model be workable in Spain?

It could be a starting point in my opinion. But there is a lot of work to be done to stimulate saving and make people aware that they need supplementary social security before such initiatives can have a real impact on the amount employees pay into supplementary schemes.

2 INI: Instituto Nacional de Industria.