Hulusi Taskiran: Chairman of the Association of Insurance and Reinsurance Companies of TurkeyMARKETS

Born in 1957 in Istanbul (Turkey). Achieved BA degree at the faculty of Business Administration at Bosphorus University in 1980 and joined the insurance industry at the beginning of 1981.

He worked for the insurance company Sark Sigorta (now Allianz) between 1981-1988. In late 1988 he left the company as the manager of marine department and joined T. Genel Sigorta as the assistant general manager in charge of marketing and technical affairs. He became the general manager of the company in May 1993.

At the same time, he had been the founding general manager of Genel Yasam Sigorta between 1998-2003. In 2001 he became the CEO of both companies until 31.12.2008, when he retired. He is Vice Chairman of the Board of MAPFRE Genel Sigorta and MAPFRE Genel Yasam Sigorta.

He was elected the chairman of “the Association of Insurance and Reinsurance Companies of Turkey” in 2005 after 6 years as a board member. He has been re-elected twice since then.

He is also the chairman of the Insurance Guarantee Fund and chairman of the mutual Agricultural Company called Tarsim A.S which is in charge of all operations on behalf of the industry and State agricultural pool.

Mr. Taskiran has been married since 1985 and has a son of 16.

"Harmonisation with EU directives has been strictly followed"

Turkey is a fascinating country as is its insurance

market which combines the European

traditional approach with the Asian potential

to grow. What is your vision of the strategy and

targets of insurance companies in Turkey?

One of the main concerns of insurance companies

in Turkey is to increase public awareness

of the importance of insurance as there is great

growth potential in this young and dynamic country.

With this in mind, the Association of Insurance

and Reinsurance Companies of Turkey has launched

a new advertising campaign to draw

people’s attention to the importance of insurance

in their daily lives.

Another key target of insurance companies is to

increase their financial strength to meet international

standards by enhancing their value and

implementing a customer-focused approach to

services.

As at May 2009, there are 61 insurance and

reinsurance companies in Turkey, 59 of them

being insurance companies (23 life and 36 nonlife)

and the remaining 2 being reinsurance

companies. Of these, 54 insurance companies

and 1 reinsurance company are active. The number

of people employed in insurance companies

is 16,019. There are 13,579 agents and 70 brokers

active in the market.

Between 2003 and 2006, Turkey’s premium income

as a percentage of its GDP (figure 2) gradually

increased from 1.43 % to 1.68 %. The drop

registered in 2007 is due to the fact that the

method for calculating Turkey’s national income

was changed. In fact, Turkey’s national income

in 2007 increased substantially compared to

2006. In 2008, Turkey’s premium income as a

percentage of GDP was recorded as 1.24 %,

compared to 1.28 % in 2007. This drop can be

ascribed to the impact of the global financial

crisis on the Turkish insurance market.

Could you briefly explain the history of the

Association of Insurance and Reinsurance Companies

to us, from your privileged position as

President? What is its role? What were the

milestones of the Association and what are its

current prospects?

The history of insurance in Turkey dates back to

the 1870’s. At that time, insurance transactions

and services were mainly carried out by foreign

insurance companies. In 1900, insurance companies

operating in Turkey decided to join under the umbrella of a “professional organisation”

and established the “Insurers’ Syndicate of

Turkey”, which had 81 members, all of them

foreign companies.

After the proclamation of the Republic in Turkey

in 1923, this Society was abolished and

“The Club of Insurers” was established in 1924,

which then took the name “Central Office of

Insurers”. In 1952, some of the members of

the Office established “The Association of

Insurance Companies of Turkey”. On the same

date, the Central Office of Insurers adopted

the name “Office of Insurers of Turkey”. In

1954, both organisations merged under the

name “Association of Insurance and Reinsurance

Companies of Turkey”. It was not until

1975 that the Association adopted the name

it uses today; “The Association of Insurance

and Reinsurance Companies of Turkey”.

The Association of Insurance and Reinsurance

Companies of Turkey is a specialised institution

with the characteristics of a unique nongovernmental

institution established by law.

Within the context of the Insurance Supervision

Law, the Association is a legal entity established

for the development of the insurance profession,

the implementation of the principle of solidarity

among insurance companies, the elimination of

unfair competition among members and the

preparation and implementation of any official

duty transferred to it by the Regulatory Body.

Membership is compulsory by law; therefore all

insurance and reinsurance companies operating

in Turkey are members of the Association.

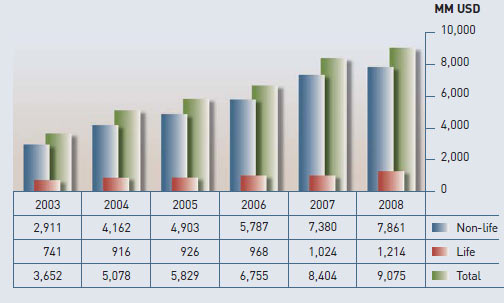

Premium Income (2003-2008) in USD

What are the main events where Turkish insurance

companies meet? What about regional

conferences where the neighbouring players

exchange ideas? Does Turkey play a leading

role in discussions as an advanced competitor?

The Association organises national and international

conferences every year. These conferences

bring together the managers and staff of insurance

companies, government officials, academics

and all other stakeholders in the sector.

In this context, we have organised international

conferences in cooperation with the OECD and

the World Bank. We hosted the CEA (European

Insurance and Reinsurance Federation) General

Assembly in 2006 and we will be hosting

the IMIA (International Association of Engineering

Insurers) General Assembly this year in

September.

Regarding our efforts in neighbouring markets,

we held the “Eurasian Insurers Conference” in

Istanbul in December 2004, with the participation

of insurers from Azerbaijan, Georgia, Kyrgyzstan,

Uzbekistan, Kazakhstan and Moldova. This Conference

provided a platform for Eurasian insurers to come together and discuss various issues.

As an advanced competitor, Turkey provides

Eurasian countries with the necessary information,

expertise and know-how whenever required.

The Association also regularly attends meetings

of the CEA, OECD, IMIA and IUMI (International

Union of Marine Insurance) and follows developments

in insurance at European and global levels.

These are then shared with member companies

through comprehensive reports and working

papers prepared by the Association.

Premium Income vs GDP (2003-2008)

Insurance Law 5684 was approved recently, on

June 14th 2007. What has it meant from the

regulatory point of view in respect of the financial

strength of insurance companies?

In accordance with the new Law, harmonisation

with EU directives has been strictly followed in

fiscal and financial matters. The recent alteration

of the minimum financial requirements to match

not only premiums and claims but also risk basis

calculations, has helped to achieve a triple increase

compared with traditional methods. As

a result, the transparency of companies’ financials

has reached a higher standard with the

introduction of the new reserve requirements.

A committee has been established in the Treasury

Department, with a view to following developments

at EU level and accomplishing harmonisation

studies regarding EU Solvency II

requirements.

All these regulations have empowered the regulatory

authority whose main mission is to protect

the insured and maintain the healthy operation

of the insurance market.

As an advanced player, Turkey provides Eurasian countries with the necessary information, expertise and know-how whenever required.

What are the main difficulties that companies

will have to face in order to fully comply with

the Insurance Law? How does it rule in respect

of insured and agents?

The major inconvenience that companies will

face in order to fully comply with the Insurance

Law is related to the companies’ financial structures.

The changes in the calculation of companies’ capital requirements (solvency) and

the establishment of new technical reserves are

related to this issue. Also, the enhanced reporting

requirements will need supplementary work.

One of the most important new features of the

Insurance Law is the Insurance Arbitration Mechanism

that consists of independent and impartial

arbitrators, operating under the umbrella

of the Association. The aim of the Arbitration

Mechanism is to bring rapid and reasonable

solutions to the problems of consumers as well

as insurance establishments.

The “Regulation on Information Regarding Insurance

Policies” also supports this system by

enhancing consumer protection. When entering

into contractual relations and during the term

of a policy, the insured is provided with information

regarding the subject matter of the policy,

cover and other conditions, as well as any changes

or developments that might affect them.

With regard to agents, those who want to be

engaged in insurance agency work must be

registered in the Register maintained by the

Union of Chambers and Commodity Exchanges

of Turkey.

Turkish authorities, when establishing the TARSIM Model, were inspired by the Spanish model for agricultural insurance.

When dealing with technical aspects of insurance,

what has the Law established on enabled

branches, the role of actuaries within the companies

and earthquake claims reserves?

Branches have been reorganised in line with

EU directives. In this context, the Insurance

Uniform Accounting System has been modified

accordingly.

With regard to actuaries, the Law compels companies

to work with a sufficient number of actuaries.

The Treasury Department is held responsible

for keeping a Register of Actuaries.

Those who want to work as actuaries must be

registered. Principles and procedures relating

to the acquisition of “actuarial status” as well

as the duties and powers of actuaries are determined

by regulation.

With the new Law, the role of actuaries in companies

has been enhanced. Many foreign companies

have entered into the Turkish market and competition in the insurance sector has

increased remarkably. This competitive environment

provides the ground for actuaries to

have a supportive role in the determination of

tariffs in non-life branches as well. On the other

hand, Actuaries also have an important role to

play in the calculation of technical reserves,

such as IBNR.

Regarding earthquake claims reserves, the new

Law introduces the “equalisation reserve”, a

reserve which is allocated for insurance branches

determined by the Department to balance claims

rate fluctuations in future fiscal periods and to

meet catastrophic risks.

There is almost no country in the world whose

insurance market is not adapting its strategies

to the current financial crisis. Could you identify

problems and opportunities in the Turkish Insurance

market?

The problems we face because of the global

financial crisis are not as significant as those

suffered by the global insurance players. The

investments of Turkish insurance companies

have not been affected at all as these are entirely

local, mainly in government bonds or bank savings.

So we do not have any problem as far as

the quantity and quality of the assets is concerned.

The most important effect of the changing

environment on financials will be a reduced

amount of earnings on investments due to the

sharp decrease in interest rates.

As a result of the financial crisis, the regulatory

authority has taken additional measures. If insurance

companies make cessions to reinsurers

below a certain rating level, this will result in an

increase in their capital requirements.

The main problem we face is decreasing insurance

demand due to the shrinking economy.

The Turkish economy is expected to have negative

growth of 4 to 6% in 2009 and we are afraid

that the insurance market will face a worse

scenario in this respect. The reduction in insurance

demand is causing strong price competition

in the market which is the main problem

for the market. Therefore gross premiums seem

to fall not only because of shrinking demand

but also rate reductions. I am personally pessimistic

about this year both in terms of growth

and results.

I believe the size of the Turkish market is a great opportunity for any foreign player wishing to use their presence in Turkey as a bridge to the Turkic markets.

Talking about foreign investments in the insurance

market, what could be the advantages

and disadvantages of the arrival of foreign

shareholders?

There has been a substantial increase in foreign

entries into the Turkish market. Many international

groups are now active. As at the end of

September 2008, foreign owned insurance companies

had a share of 53.91% of the total capital

and a share of 75.22% of total premium income.

The interest of foreign groups is a clear indicator

of the growth potential of the Turkish market,

which is young and developing.

Know-how transfer and new employment opportunities

are important advantages of foreign

investment. However, if there is no insurance

awareness in society, increasing overall premium

income is impossible. Therefore new entries into

the market should be supported by new insurance

awareness campaigns and advertisements.

Otherwise, companies will continue to

have intense competition over a relatively small

and limited portfolio. Competition which has

always been fierce has become even more

aggressive with the entry of foreign investment

into the market. In 2006 and 2007, foreign investors paid around USD. 100 million for 1% market

share excluding excess capital and they seem

to be prepared to pay more to increase their

market share.

Another interesting solution was created

more recently for systemic risks, the TARSIM

pool. Do you think it will become as robust

as the US and Spanish models for agricultural

insurance?

TARSIM (Agricultural Insurance Pool) provides

insurance coverage for catastrophic risks that

threaten the Turkish agricultural industry and

which cannot be carried by a single insurance

company. Turkish authorities, when establishing

the TARSIM Model, were inspired by the Spanish

model for agricultural insurance. There are no

major differences between the systems in Spain

and Turkey. The system in Spain enshrines a

reinsurance company established by the State

and a managing company like TARSIM A.S of

which I am Chairman of the Board. The Spanish

mechanism has its own legal entity and is more

independent than ours. In our system, there

is no specific reinsurance company and we

work with international reinsurance markets.

In short, there is only an organisational difference

between the two models. Spain is an

important model for Turkey as the Spanish

system has been functioning successfully for

about 30 years. The Turkish model, on the other

hand, is showing steady growth and in my view,

it will become as robust as the one in Spain

in the coming years.

The international press has already reported

on the completion of the Marmaray rail link

under the Bosporus. Transport in Istanbul will

improve significantly; could you tell me what

other important infrastructure works are in

process or planned in Turkey in the near future?

The Third Bosphorus Bridge and the second

tunnel for motor vehicles are the two main

projects being planned within the context of

connecting the Asian and European continents.

In addition, the construction of two tunnels at

a total cost of nearly USD 32 Million continues.

One of these tunnels is about to be finished.

We would welcome your comments about the

Turkic Republic insurance markets, such as

Kazakhstan and Azerbaijan for instance, and

their foreseeable development.

These are growing and promising markets. Most of the premiums are generated by the private

sector mainly, which is a very positive sign.

Kazakhstan especially is a rapidly developing

country which reflects this in the remarkable

growth of the insurance market in recent years.

We must admit that the growth of insurance

business in these countries is mainly dependent

on the countries’ infrastructural and

industrial development. However, taking the

increasing level of educational and cultural

development of the public into consideration,

there is no reason for not being optimistic in

that respect as well.

Turkish investors are the second largest group

of foreign investors in Kazakhstan with more

than 2.5 billion USD. The Turkish insurance

sector is doing business in Kazakhstan in a

cooperative way with local companies to serve

their Turkish clients for insuring their investments

such as hotels and big shopping malls,

particularly in respect of engineering and property

risks. Business seems to be dropping off

nowadays because of the global crisis which has

had a major effect on both economies, but I still

believe that these countries are big opportunities

for our sector, although I think that we unfortunately

were late in taking positions and action

in these two markets. I also believe the size of

the Turkish market is a great opportunity for

any foreign player wishing to use their presence

in Turkey as a bridge to these markets.

Association of Insurance and Reinsurance Companies of

Turkey

http://www.tsrsb.org.tr/tsrsb_eng/

TARSIM

http://www.tarsim.org.tr/

The Turkish Catastrophe Insurance Pool (TCIP) has been working for almost nine years. It

is another model of public and private partnership. How do you think it will evolve in a medium

term loss-free scenario?

The Turkish Catastrophe Insurance Pool (TCIP) was launched by the Turkish government

in cooperation with the World Bank in 2000 after the big earthquake of 1999. TCIP is a

compulsory insurance programme that provides earthquake cover to householders up to

certain limits with affordable premiums depending on risk zones, construction types and

gross floor space of houses.

TCIP not only aims to alleviate the economic burden on the State in the event of an earthquake,

but also ensures that risks are shared within the country with a certain amount of risk transfer

to international markets through reinsurance. It also increases insurance awareness among

the Turkish population; makes the insurance system apply sound standards to construction

and guarantees the accumulation of necessary long-term resources for the compensation

of earthquake losses.

TCIP is an important example of a functioning public-private partnership. While public authorities

are responsible for the establishment of the legal framework, the conduct of regulatory

supervision, the provision of risk management support and disaster management, the private

sector is in charge of sales, operational services and claims management as well as the provision

of risk management support.

However, the penetration level is currently 23%. This simply means that out of 100 households,

only 23 are within the system. In a medium term loss- free scenario, we do not expect the

penetration level to increase as house owners are not adequately encouraged to buy insurance.

There are no penalties or fines imposed. The lack of State interest, support and long-term

strategies that transcend governments are the main obstacles.

During the TCIP’s first five years of existence, it was not been possible to accumulate a substantial

amount of funds. However, the total amount of accumulated funds had reached almost one

billion TL by 27th April 2009. When a medium-term projection is made in terms of a loss-free

scenario, TCIP is expected to create a fund of about 3-4 billion TL in 7 years.