A dynamic and interactive insurance dictionaryGENERAL

Mª José Albert & Ana Mª Sojo. Instituto de C.C. del Seguro

MAPFRE Foundation (Madrid - Spain)

All human activities make use of their own vernacular, containing a specific or shared vocabulary of words acquired from a language during the practice of the activity in question.

As one area of human and economic activity, insurance also has its own code of communication which has evolved since time immemorial, as ancient as the concept of human solidarity.

If the quantity, quality and precision of these linguistic expressions reflect the level of development attained in a specific area, then it may be said that insurance is a highly sophisticated sector of economic activity where terms, expressions and concepts originating from various fields coexist; it may therefore be classified as a mature sector within the financial world in which it operates.

The MAPFRE Dictionary of Insurance was developed under the auspices of Instituto de Ciencias del Seguro of MAPFRE FOUNDATION, and it meets one of the Institute’s basic objectives: to promote and disseminate the culture of insurance at all levels.

What is a dictionary?

The word “dictionary” is derived from the Latin word dictionarius which in turn originates from dictus, meaning “the act of saying”. The predecessors of dictionaries were glossaries, which collected together the words or terms in a particular semantic field.

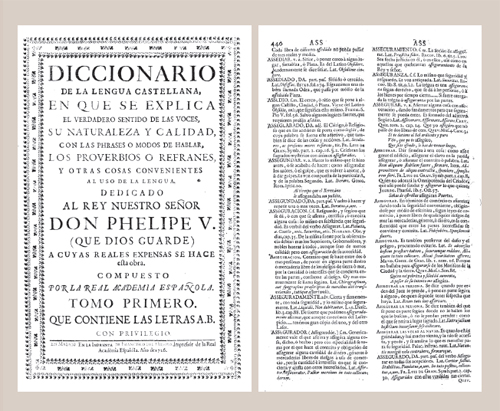

According to the definition assigned by the DRAE1, a dictionary is “a book which collects and explains words in one or more languages, relating to a specified science or subject, in an ordered manner”.

Predecessors

Published in 1972, the Basic MAPFRE Dictionary of Insurance quickly became a classic in the insurance world, especially in certain Latin American countries. Its authors, Julio Castelo Matrán and José María Pérez Escacho, were the real pioneers of this enormous task of systematizing and disseminating knowledge.

The original Dictionary was followed by further editions (in 1988, 1990 and 1992) with very significant growth in the number of terms (which increased from 1,500 to 4,000) and with the addition of more concepts and expressions; the incorporation of a trilingual glossary also enhanced the educational value and international nature of the work.

Terms, expressions and concepts originating from various fields coexist in insurance, so it may be classified as a mature sector within the financial world

The most recent version, published in 2008 with 5,400 expressions, improves substantially on the preceding editions. Moreover, large numbers of terms have been revised, either because they had become outmoded or because it was possible to improve their definitions. Certain entries were also discarded because they had fallen out of use or were becoming obsolete, especially in relation to technology. At the same time, the new insurance landscape and the process of economic globalization have resulted in the introduction of numerous concepts which did not exist when the previous versions were compiled.

As well as words derived from insurance practice in its strict sense, the Dictionary includes terms originating from the Insurance Sciences, as they are known: law, actuarial science and finance. Law and its application to the insurance context is represented by the terms relating to civil, commercial, procedural, labour and administrative law that are necessary in order to understand insurance, pensions and risk management. There are numerous terms relating to actuarial science and finance, which enable clarification of questions concerning the technical aspects of insurance as such, and the treatment of risks. The Dictionary also includes entries related to management, covering all aspects of commerce, accounting, auditing and technology.

Online dictionary

The latest (2008) edition incorporates the legacy of the past while adopting an innovative approach that is appropriate to the 21st century. This is a dynamic work that is continuously updated, given that it has a corresponding version on the Internet, designed as a forum for collaboration and feedback where users and researchers can contribute terms and different meanings for existing terms or even suggestions of any sort regarding deletions or emendations to the Dictionary’s content.

www.diccionariomapfredeseguros.com

Online publication of the Dictionary goes beyond the mere posting of content: it also allows web users to ask questions or seek advice on its content and to obtain useful information, so that problematic or confusing terms can be identified and alternative usages or terms that were not initially recorded can be added.

The online edition is destined to become the living and evolving adaptation of the Dictionary, freed from the restrictions of the printed version; its content can be continuously updated, expanded and amplified. It was consulted more than 700,000 times in 2010.

The dictionary uses the GSA (Google Search Appliance) technology to perform searches. It is possible to search for a word or a term, or to enter free text in the search box, which also allows navigation in alphabetic order. All the terms have a corresponding translation into English, and they can be located in either language.

The Dictionary can easily and quickly be integrated into other websites, and a direct link to the search engine can be included via banner.

Online publication of the Dictionary allows web users to ask questions or seek advice on its content so that problematic or confusing terms can be identified and certain terms that were not initially recorded can be added

The future

The welcome accorded to the Dictionary in various Latin American countries will result in a new edition to cover special terminological features of the different Spanish-speaking countries on that continent, both as regards the legal framework of the various jurisdictions and their main insurance usages, customs and practices.

Likewise, the forthcoming Portuguese version of the Dictionary will reflect the special characteristics of the insurance markets in Brazil and Portugal.

Concluding thoughts

Andreu and Sieber (2000) claim that knowledge is personal, in that it originates and resides in the individuals who assimilate it as a result of their own experience, i.e. their own activities (whether physical or intellectual) and incorporate it into their personal heritage, being “convinced” of its significance and implications and articulating it as an organized entity which lends structure and meaning to its separate “parts”.

Mutatis mutandis, organizations also learn, develop experience and generate knowledge, which they then explain and transmit. This is what has taken place in MAPFRE Group which, moreover, has established a characteristic corporate culture based on the development and dissemination of what may contribute to improve the practice of insurance science.

It would be impossible to end this article without offering some words of sincere thanks to those who have turned this exciting project into a reality: Ignacio Hernando de Larramendi, Julio Castelo Matrán, José María Pérez Escacho, Antonio Guardiola Lozano and those responsible for the latest expanded and revised edition: María Luisa Castelo Marín and Julio Torralba Martínez. We should also mention the contribution of José Jurado, who translated all the terms into English.

Organizations learn, develop experience and generate knowledge, which they then explain and disseminate

“To insure” (Diccionario de Autoridades / Dictionary of Authorities, Royal Spanish Academy,

1726): In commercial terms, it means to guarantee, giving all appropriate security, making it

binding by means of a written deed, according to commercial laws, rendering goods, commodities

or money free of any marine risks in conformance with what is agreed and contracted

between the interested parties.

“To insure” (Dictionary of the Royal Spanish Academy, twenty-second edition): To provide cover

for an object and the loss relating thereto which its owner may sustain due to shipwreck,

fire or any other accident or reason, creating an obligation to compensate the said owner for

the total or partial amount of the said loss, subject to the agreed conditions.

1 Dictionary of the Royal Spanish Academy www.rae.es