Subsidised agricultural insurance in Turkey (TARSIM)AGRICULTURAL

Bulent Bora. General Manager of TARSIM. Turkey.

History

Traditional agricultural insurance began in Turkey in 1957. Although Turkey’s rural population accounts for a large percentage of the total population, only 0.5% of agricultural areas in Turkey were insured before TARSIM came into being. Today, TARSIM provides crop and livestock insurance.

Two programmes were available to help crop producers recover from the financial effects of natural disasters and protect them from unavoidable risks associated with adverse weather:

- Government Aid Programme: After catastrophic events, the Government made financial assistance available to farmers on an ad-hoc basis, primarily as direct crop disaster payments and emergency livestock assistance.

- Private insurers: In defence of their legitimate interests, these tended to insure only low-risk customers or customers with very specific risks, as there was extensive information and experience regarding the effect of such risks.

The situation in the past was highly unstable and cannot serve as an effective platform for further development. It represented considerable risk for the insurance companies, a source of confusion to producers and was inaccurately priced.

Moreover, the entire system was based on limited data, inadequate actuarial expertise, a lack of transparency, and also under-funded research, coordination and monitoring.

To buy a TARSIM policy, it is sufficient to provide a citizen identity number

These approaches and the long delay in allocating resources to farmers showed these measures to be rather inefficient and inappropriate as the only instrument for meeting farmers’ needs. Insurance was considered a promising solution for the future, with a business model based on fulfilling obligations from insurance contracts on a sustainable basis.

The “Agricultural Insurance Act” was finally passed on 14 June 2005 after several unsuccessful attempts to establish an agricultural insurance system which allowed public-private partnerships in Turkey’s agricultural insurance sector.

Turkish farmers are our masters and partners

Building understanding among key interested parties

Agricultural insurance systems have been established in a number of countries around the world, albeit that some have proved more effective than others. Turkey has adopted a very similar system to the Spanish management structure, which allows those involved to cooperate on an effective platform in order to further develop the system defining risk management responsibilities. It meets all the following requirements:

- Mechanisms for public-private dialogue.

- Continuous updating using the contents of agendas.

- Development of policy tools for dialogue with the Government.

It includes excellent partnership incentives to ensure that any problems arising in the system are promptly remedied.

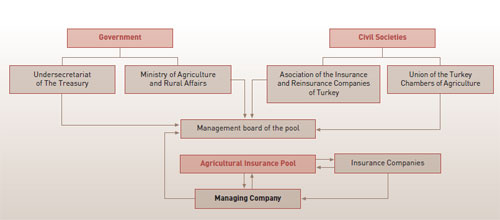

In this context, the Agricultural Insurance Pool has been devised as a “public-private partnership” and has two management bodies:

- The Management Committee: the Pool’s

Board of Directors

The Management Committee lays down procedures and principles for the operation of agricultural insurance to compensate farmers for losses in their agricultural activities arising from natural hazards. - Managing Company:

TARSIM has a management entity, established as a private corporation by insurance companies writing agricultural business, to carry out all the tasks of the Pool within the scope of the Act. TARSIM is currently made up of 22 insurance companies licensed to transact agricultural insurance. All insurance companies licensed to write agricultural insurance have equal shares in the managing company.

We call our system TARSIM, which refers to integrated agricultural risk management as per the above organisation chart.

TARSIM organisation chart

Risk transfer mechanism

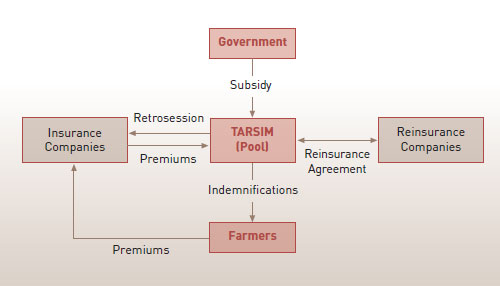

- All premium is collected by the individual insurance companies, and the total risk is transferred to the Pool.

- The Pool is authorised to retrocede risks to insurance companies (voluntarily participation).

- Where retrocession does not take place, reinsurance cover through domestic and international reinsurance companies is required.

- As a last resort, if the reinsurance cover provided by domestic and international reinsurance markets is insufficient, the Government will provide Catastrophe Stop Loss protection.

TARSIM

We have made the following commitments:

- To contribute to the development and generalisation of agricultural insurance.

- To provide standard insurance contracts covering the risks falling within the scope of the Act.

- To centralise and standardise loss adjustment activities.

- To have claims processed quickly and paid fairly by a central entity.

- To lay down procedures and principles for the operation of agricultural insurance.

- To provide insurance coverage for catastrophe risks like drought, frost, etc. that could overwhelm an individual insurance company.

- To expand reinsurance capacity and coverage by introducing incentives for participation in reinsurance.

- To make effective, joint use of insurance companies’ information, human and financial resources.

- To make effective use of Government subsidies and the Government’s Catastrophe Stop Loss protection.

- To prevent unfair price competition.

- To encourage participation in insurance.

Current situation

The levels of risk vary considerably from one region to the next, from one type of farm to the next, and from small to large farms, due to the different topography and climatic conditions found in different parts of Turkey. The development of agricultural insurance in each country is linked to farmers’ needs. Designing an acceptable new crop insurance scheme is a fine art that involves jointly analysing all available local data (yield, climatic conditions, affordable prices for cover).

Otherwise, weaknesses in underwriting guidelines may adversely affect the economic basis of TARSIM, or farmers may not be able to afford the cover. This could affect TARSIM’s ability to meet its obligations to farmers, which in turn could severely erode confidence and cause instability in the first few years of TARSIM’s existence.

Operating agricultural insurance in Turkey

Since the outset, TARSIM has therefore given great weight to actuarial conditions in determining its strategy. In order to implement this policy,

- Available data compiled by insurance companies and the hail insurance statistics of altogether 6,800 villages, as well as a “Hail Premium Tariff” based on Hail Risk Zones and “Crop Hail Sensitivity Classes” per village, have been revised.

- Phenological stages of fruit varieties and meteorological data have been correlated on village basis. A “Frost Premium Tariff” and Frost Risk Zones have been set up based on this correlation.

- For Storm Risk Zones, long-term wind speed and meteorological data have been analysed and a “Storm Premium Tariff” has been established.

- For Flood Risk Zones, records from the Ministry of Agriculture and Rural Affairs and the Public Waterworks Administration covering more than 30 years have been compiled and analysed.

The “Agricultural Insurance Act” was finally passed on 14 June 2005

The above tariffs mean that Hail, Flood, Storm, Whirlwind, Fire, Earthquake, Landslide and the Frost risk for fruits, all of which have a direct systemic impact on the economic activities of the rural sector in general and on the agriculture sector in particular, can be covered all over Turkey under the Crop and Greenhouse insurance lines of business.

In addition, any kind of registered animals which are raised for commercial purposes are covered by TARSIM against all risks except epidemic diseases.

Consistent operating standards

Loss adjustment activities

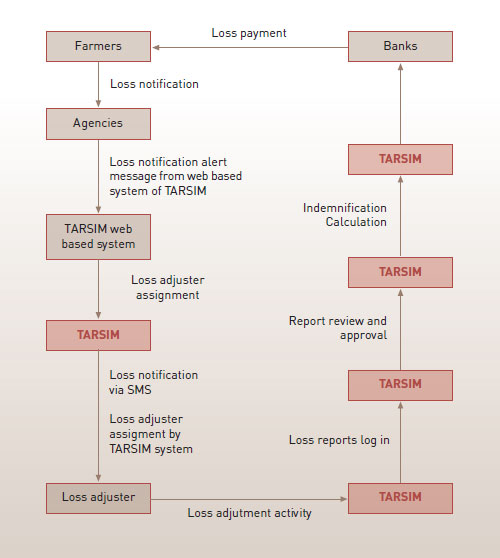

Where agricultural insurances claims are concerned, TARSIM’s own business activities and the insurance sector’s traditional loss adjustment activities have been integrated and are now carried out by TARSIM. The previous patchwork of loss adjustment activities has been centralised by implementing improved and better-organized loss adjustment activities.

In insurance business, it is generally the case that where indemnity payments are slow to reach policyholders and costly to administer this will deter farmers from buying the insurance. TARSIM can overcome such difficulties by making use of its own Web-based system.

En el negocio asegurador por regla general, puede afirmarse que si los pagos de las indemnizaciones tardan en llegar a los asegurados y su administración resulta cara, se disuade a los campesinos de adquirir el seguro en cuestión. Gracias a un sistema web propio, TARSIM puede solventar tales dificultades.

The development of agricultural insurance in each country is linked to farmers’ needs

Obligatory use of IT systems

Information is vital for assessing and evaluating risk but tends to be expensive to obtain, process and analyse. When our underwriting principles are examined more closely, it becomes clear that rapid, easy access to reliable data is key to TARSIM’s business. Information is the oxygen of TARSIM’s business. Our IT system allows us to collect, store, sort, distribute and use information anywhere in Turkey that has an Internet connection.

The flexible Web system provides full and up-to-date information about the way we deal with agricultural insurance business and claims organisation. Our Web system allows us to review our operations, policies, and projects to identify any needs and requirements of farmers that may be enhanced by a different approach or that may warrant being abandoned altogether. It also illustrates how we actually put the principle of standardisation into practice.

Moreover, one of the important conditions for improving the system, especially when considering their introduction in Turkey, is suitable technology that will allow the monitoring and collection of data to become more reliable, efficient, and accurate.

One example of a technological innovation is the Web-based interactive system.

Its benefits:

- Accessible anytime from anywhere via Internet connection.

- Information is available in real time.

- Immediate processing.

- Compatible with Office tools, does not require complex software products.

- Adaptable to changes in insurance underwriting conditions.

- Better control and more comfort.

- Information can be shared among diverse platforms.

- Functions for tariffs, underwriting, document production, claims processing, reporting and accounting are managed for insurance companies, brokers and agents.

- Implementation of new lines of business is done through flexible tools available within the system.

Farmers’ information is checked through the National Farmer Registration System on the TARSIM Web system before any policy is issued. To buy a TARSIM policy, it is sufficient to provide a citizen identity number.

All policies are stored in the TARSIM database. The data can be transmitted from TARSIM HQ to insurance companies in real time or later.

The vast majority of paper-based reports, policies and other paper documents are scanned and turned into electronic, editable files in a variety of data formats to facilitate the management of documents and records.

Success and efficiency in agricultural insurance depend on a multitude of interacting factors: economic conditions, climate change, farmers’ behaviour, confidence and so on. In the long run, TARSIM will get the best of our efforts, energy, and resources from the actuarially sound premiums, plus the flexible and reliable Web system.

| 2007 | 2008 | 2009 | |

|---|---|---|---|

| Number of policies | 113.413 | 134.881 | 158.661 |

| Premium income (in TRY '000) | 33.147 | 50.885 | 66.244 |

| Insured value (in TRY '000) | 764.340 | 1.150.088 | 1.500.169 |

| Number of insured cattle | 28.703 | 37.193 | 58.028 |

| Insured area (da)* | 1.804.304 | 2.293.434 | 2.938.557 |

| Number of risk inspections and loss notifications | 31.083 | 44.048 | 57.265 |

* 1 da (dunam)= 0.1 hectares

TRY = EUR 0.464 r.o.e. 31/12/2009

TRY = EUR 0.465 r.o.e. 31/12/2008

TRY = EUR 0.582 r.o.e. 31/12/2007

As the Turkish economy grows, agriculture will also grow and gain in economic importance. We therefore expect this to become an even more attractive opportunity over time, and TARSIM will be perfectly positioned to take advantage of it.

TARSIM aims to meet the full expectations of our farmers -whom we define as our masters and partners- by making agricultural insurance more accessible, more efficient, and more sustainable, like a financial supermarket for farmers.