Shelter from the StormNATURAL PERILS

Anna Hargis. Director of Advertising Shelter Insurance Companies, Missouri (U.S.A.)

Employees and agents at Shelter Insurance® understand storms. Dealing with claims and helping customers after a catastrophic event is part of the Shelter Insurance group of Companies’ foundation.

That fact has helped build Shelter from a small insurance company founded in 1946 to a well-respected regional insurance group recognized for its financial strength and stability. The Ward Group® recently ranked the Shelter Insurance Group (Property and Casualty) for the second year in a row among the top-50 performers out of more than 3,100 U.S. Property & Casualty insurers. The group and the Shelter Life Insurance Company were both recognized as one of the top 50 safest and best managed companies in the industry.

90% of the earth’s tornados occur within the Shelter Insurance® operating territory

During the past decade, the Shelter team has dealt with a myriad of catastrophic events ranging from hail storms to hurricanes. Shelter insures property and casualty risks in fourteen of the United States that reach from the Gulf of Mexico to the Colorado Mountains and the Nevada desert. One interesting meteorological fact is that 90% of the earth’s tornados occur within the Shelter Insurance® operating territory. Employees and agents frequently monitor weather reports, watching the skies with a wary eye.

The vans can be used as communication centers for customers and allow claims adjusters a base for field operations

“The past two years we have experienced strong storm activity in many parts of our operating territory,” reports Vice President of Claims Matt Moore. “We are handling storm claims at unusual times during the year, including through the winter months, and that can strain our resources. I continue to be impressed by the hard work and dedication of our claims team, especially those firstresponders to catastrophic situations.”

One way the Shelter Claims team has dealt with the constant battle between rising costs and controlling expenses is to invest in technology. A project to streamline the claims adjusting process led to a system called the “Claims Workstation System” or CWS. This allows electronic processing of claims forms and has significantly decreased the reliance on physical paperwork and allowed the claims department to process claims faster without expanding the existing staff. “This new technology is allowing us to better focus on our customers’ needs. Providing outstanding customer service is the most important thing we do. We want to deliver the promise we made when our agents sold our customers their policy.” Mr. Moore said.

In 2005, Hurricanes Katrina and Rita devastated a large section of two states that Shelter serves. Louisiana and Mississippi residents faced storms of epic proportions that left entire areas buried in debris. The Shelter Catastrophe team mobilized and immediately began taking care of customers. They dealt with the humanitarian effort by providing food, water and emergency funds for policyholders displaced from their homes.

“We want to deliver the promise we made when our agents sold our customers their policy”

Whether it was helping homeowners find ways to cover the holes left in roofs or providing safe food and water to hungry families, Shelter employees and agents worked with emergency responders after the hurricanes. The employees and agents were also deeply affected by the stories of loss. One customer visited the Shelter emergency claims site soon after the storm. He joked with staff members about not even being able to brush his teeth for days, but remained in good humor about the situation. Unfortunately, staff members learned that the customer suffered a heart attack and died a few days later while trying to take care of property damage. While roofs can be repaired and trees replanted, the human toll of the storms is the most difficult challenge to accept.

The aftermath of the hurricanes was a time of change for Shelter’s Claims department. While Shelter was one of the few insurance companies that were spared the high-profile consumer lawsuits and complaints after the hurricanes, the claims leadership team believed it was an opportunity to evaluate overall effectiveness of their processes. The CWS project moved forward at a rapid pace, and the group evaluated options for improving communications and outreach to customers following catastrophic events. This effort led to the recent acquisition of three large vans equipped to quickly travel to storm sites. The vans can be used as communication centers for customers and allow claims adjusters a base for field operations. “The mobile Storm Response Vehicles have become a valuable tool for our claims team,” Mr. Moore added. “These vehicles feature designs that identify them as Shelter Storm Response vans and our customer feedback has been very positive.” The company originally purchased three vans, and will evaluate the need for additional vehicles in the future.

In 2009, the Shelter Claims team has again faced record number of storm claims. Hailstorms, tornadoes, and high winds have caused extensive property damage in nearly every state in Shelter’s operating territory. The Companies have remained financially strong through this challenging time due to on-going conservative fiscal practices.

One of those practices has included something unique to Shelter’s balance sheet. The Companies established both an earthquake reserve and a catastrophic weather reserve several years ago, which while more conservative than other companies is an acceptable financial practice under the law. These reserves are funded through a portion of the premium collected from each property policy and are used under very specific financial conditions. The earthquake risk to the operating territory is through the New Madrid fault line, which continues to generate earthquake activity since the catastrophic event that made it famous more than one hundred years ago. Shelter has not had to tap into the special earthquake reserve since establishing it; however the severe weather fund has been utilized.

The Claims leadership team recently developed a training program designed to teach leaders in other departments throughout the Companies about the Shelter claims process. The two-day Executive Development seminar was presented to Directors and Managers from other departments. The auto and homeowners’ policies were reviewed and the departmental structure was explained in detail. The training program utilized a case study approach that gave the attendees an opportunity to answer challenging questions based on the information provided. The feedback from attendees was very positive and many commented on how the training program provided a greater understanding of the challenges facing the Claims department, especially in light of the storm situation.

| Rank | Date | Cat. No. | Event | Net paid |

|---|---|---|---|---|

| 1 | March 11-13 / 2006 | 73 | Wind, Hail & Related Perils | 101,243,637.81 USD |

| 2 | August 28 / 2005 | 65 | Hurricane Katrina | 86,883,170.30 USD |

| 3 | September 23 / 2005 | 66 | Hurricane Rita | 73,455,869.40 USD |

| 4 | May 4-7 / 2003 | 43 | Multi-State Tornado,Wind, and Hail | 68,037,126.79 USD |

| 5 | April 9-11 / 2008 | 88 | Wind, Hail & Related Perils | 56,026,423.06 USD |

| 6 | April 9-12 / 2001 | 21 | I-70 Hail & Wind | 55,914,092.18 USD |

| 7 | October 3-5 / 2002 | 37 | Hurricane Lili | 36,106,672.96 USD |

| 8 | Abril 1-3 / 2006 | 74 | Wind, Hail & Related Perils | 33,363,806.39 USD |

| 9 | May 7-9 / 2009 | 96 | Tornado, Straightline Winds, Hail | 29,120,882.87 USD |

| 10 | May 3-6 / 1999 | 74 | Oklahoma City Tornado | 25,914,210 USD |

Shelter Insurance® will continue analyzing detailed data reports about claims from storms. Recent satisfaction surveys conducted after the customer’s involvement in a claim indicate that policyholders continue to believe that Shelter delivers on the promise sold with each policy. Those surveys also indicate that the customers would recommend Shelter to a friend. Additionally the Claims Department instigated a process to survey affected agents after a storm to seek other thoughts and ideas on how to continually improve their processes. Combining a high level of customer satisfaction and a strong financial position, the Shelter Insurance Companies’ employees and agents continue to work for a successful future. That future will mean dealing with catastrophic storms, but that is something the Shelter team understands and is ready to handle.

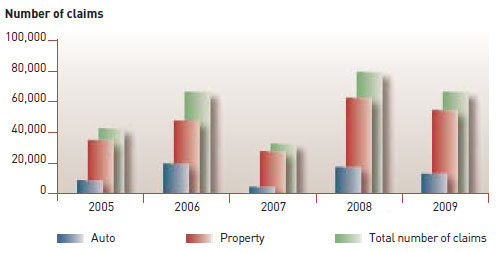

Storm claims for the last 5 years

The Shelter’s Group Companies established both an earthquake reserve and a catastrophic weather reserve

This article is authored by Anna Hargis, Director of Advertising for the Shelter Insurance Companies. Ms. Hargis has held this position for 11 years and prior to joining Shelter Insurance®, spent 11 years in television marketing and promotion with the local NBC affiliate in Columbia, Missouri. She is a member of the Columbia Chamber of Commerce and is active in the Chamber Ambassadors program as well as Women’s Network. She volunteers with the Internet Citizen’s Advisory Group for the city of Columbia. She received a Bachelor’s Degree in Journalism and a Master of the Arts Degree in Communication both from the University of Missouri. She resides in Columbia, Missouri with her husband and son.